The mobile games market is growing at a fast speed (52% during 2016 according to Newzoo), making it a truly a global area of business. However, as is in any other global business, there are differences in consumer needs, desires and behaviors. It is crucial for any mobile games company to learn about these differences as this information is the key to unlocking success – and profits – worldwide. In the mobile games marketplace, these differences are reflected on the types of games that become successful in different markets.

An overview of how hugely different these various markets are can be seen when looking at the top grossing lists of three of the biggest mobile games markets in the world: US, Japan and China.

It’s clear that these three markets are different, but how about the dozens of the other markets? This was the question we wanted to answer – and to back it up with facts. To make the results easy to understand, we wanted visualize the answers, and to create the “true world map” of mobile game markets.

Measuring the similarity between markets

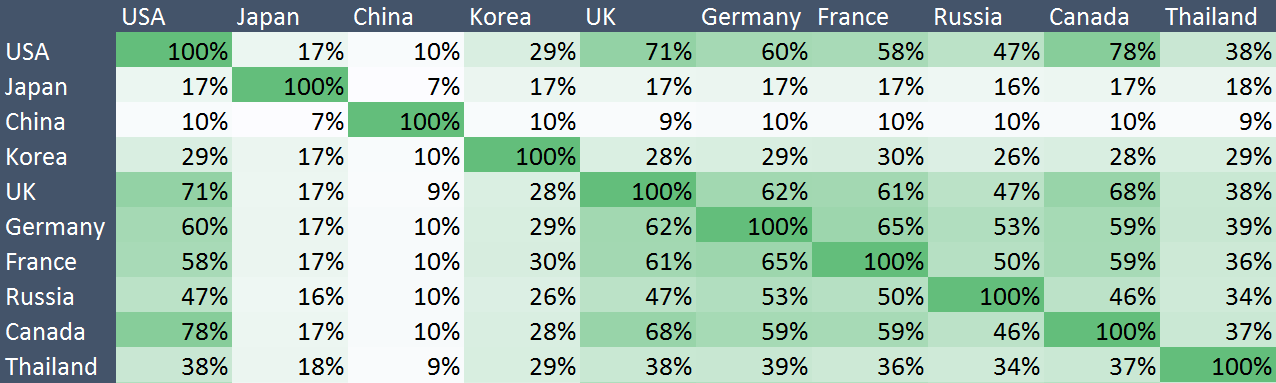

To measure the similarities between the markets we took a simple but effective approach: we calculated the number of the same game titles these markets have on their top grossing list. For example, 7% of the top grossing 500 games in China and Japan are identical, whereas the share of the exact same games in UK and the U.S. is 71%. These results indicate that – when it comes to mobile games — the U.S. and UK are much more alike than China and Japan.

This calculation was conducted pairing all 40 of the biggest mobile game markets with each other. Below you can see an interesting snapshot of the results. If this piqued your interest and you want to access the whole data set, please contact me (vp(at)gamerefinery.com).

Differences between the biggest 40 mobile game markets

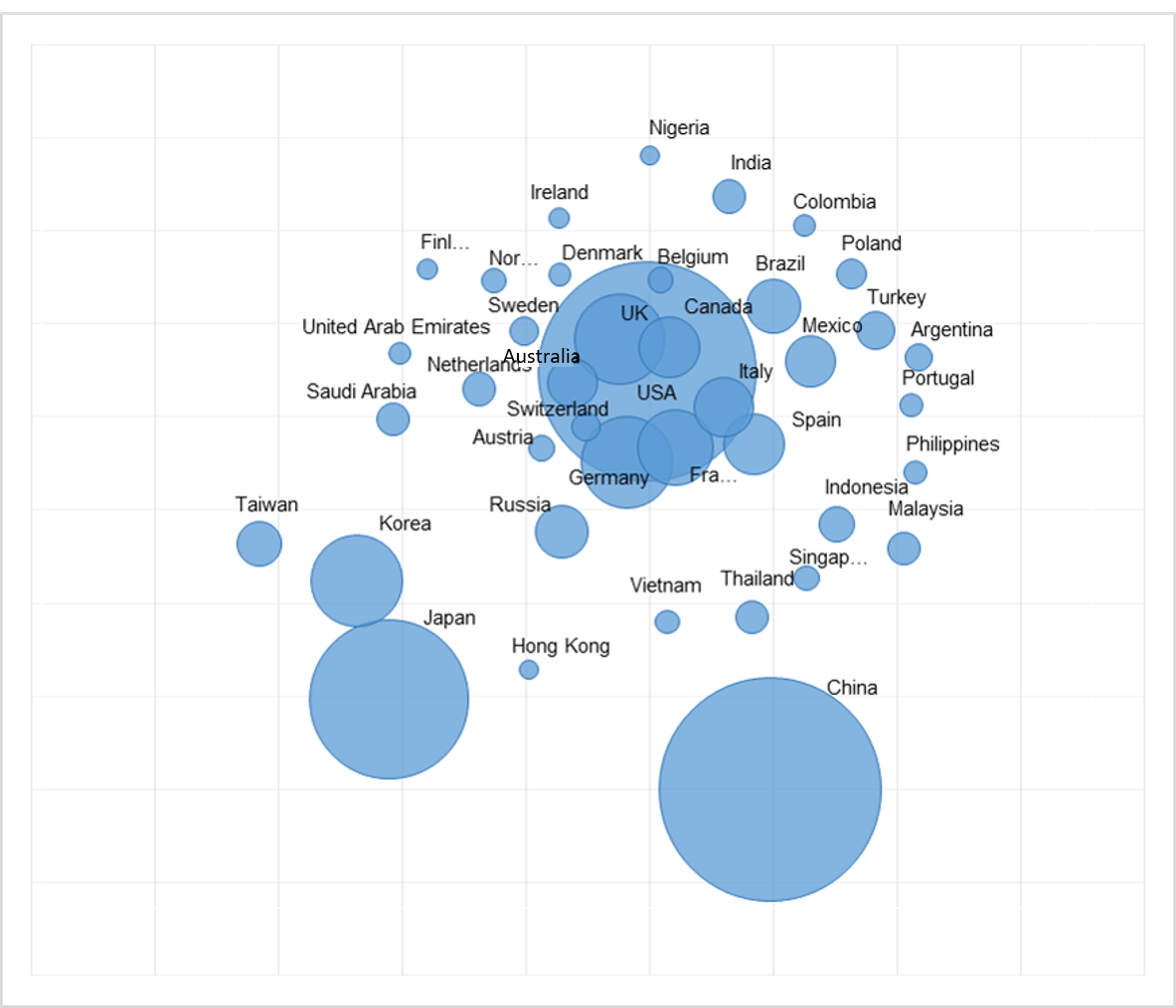

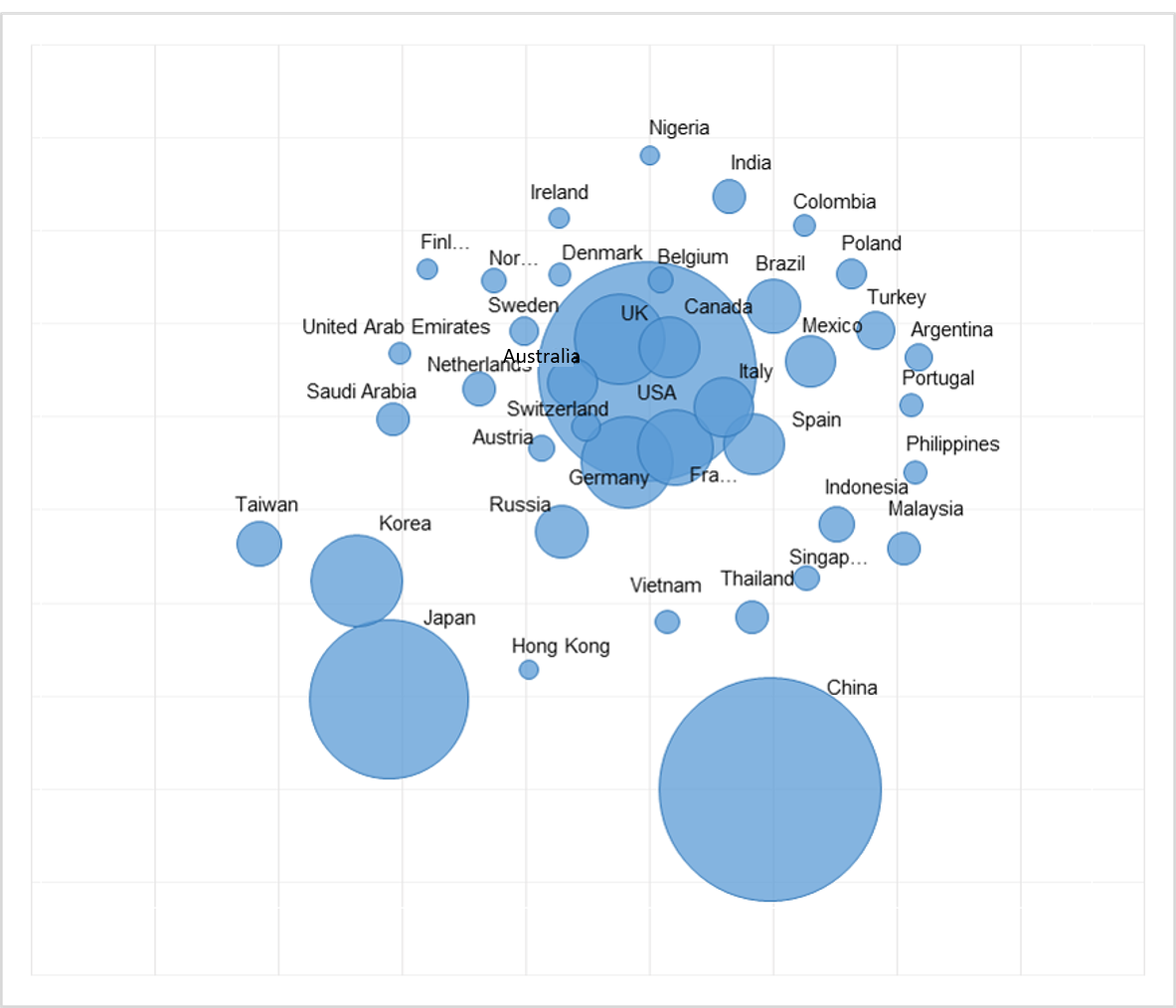

While there are multiple different approaches available to visualize difference matrixes, we wanted to stick with a true proven classic; a statistical method called multidimensional scaling. The idea behind this method is, in short, to place all the markets onto a map. The distance between any two markets shows the difference between them.

- The closer the markets are to each other, the more they have in common within their top grossing 500 games, making them more similar.

- The size of the bubble indicates the estimated market size (revenue) (www.newzoo.com)

So, what can you learn from this analysis?

Firstly, the three biggest markets, i.e. China, US and Japan, are very different from each other. For example, currently there are 20 casino games in the top 100 grossing list within the U.S., but in China or Japan there are none to be found. On the other hand, in China action RPGs are very popular, but in the U.S. only a few have managed to reach the top places.

Furthermore, while the U.S. is very similar with many of the big western nations, content in markets like Russia and the Nordic countries differ from the rest of the western markets. The map also shows that South East Asia, Spanish speaking countries and the Middle-East form their own clusters

Key takeaways

- Take care when choosing the countries for your soft-launch. For instance, while the U.S. market is a good benchmark for many countries, it is not representative of them all.

- If you are a western developer aiming to succeed in East Asia, there are things you should consider. While language localization is a good start, is also crucial to choose the right genre, feature set and visual style for your game. For example, according to our analyses, choosing the right visual theme and style is much more critical than in the U.S.

- If you are an accomplished Asian publisher attempting to conquer the western markets, it’s important that you publish the right games from your portfolio in the west. A big marketing budget is not a guarantee of success. The most potential game might not be your best performing Chinese hard core RPG, but some other game that have the right feature set that matches the market requirements of the US audience.

- It is very difficult to be successful in a world-wide scale, and only a handful of developers have been able to do it. If you want to build truly a global success you need to be able to understand and identify the game features that are universally effective and must-haves (for example, certain social elements and monetization mechanics) and at the same time understand different local markets and take those into account when localizing your game.

If you need help with picking the right soft-launch country, estimating the potential of your game in a specific target market or optimizing your games feature set locally or globally, don’t hesitate to contact us! We are here to help you reach global heights. 🙂

Stay tuned as we’ll publish more findings and insight regarding different mobile games markets in future posts