If you know what an “auto chess” game is, or you have played League of Legends, Teamfight Tactics (referred to as “TFT” from here on) probably needs no introduction.

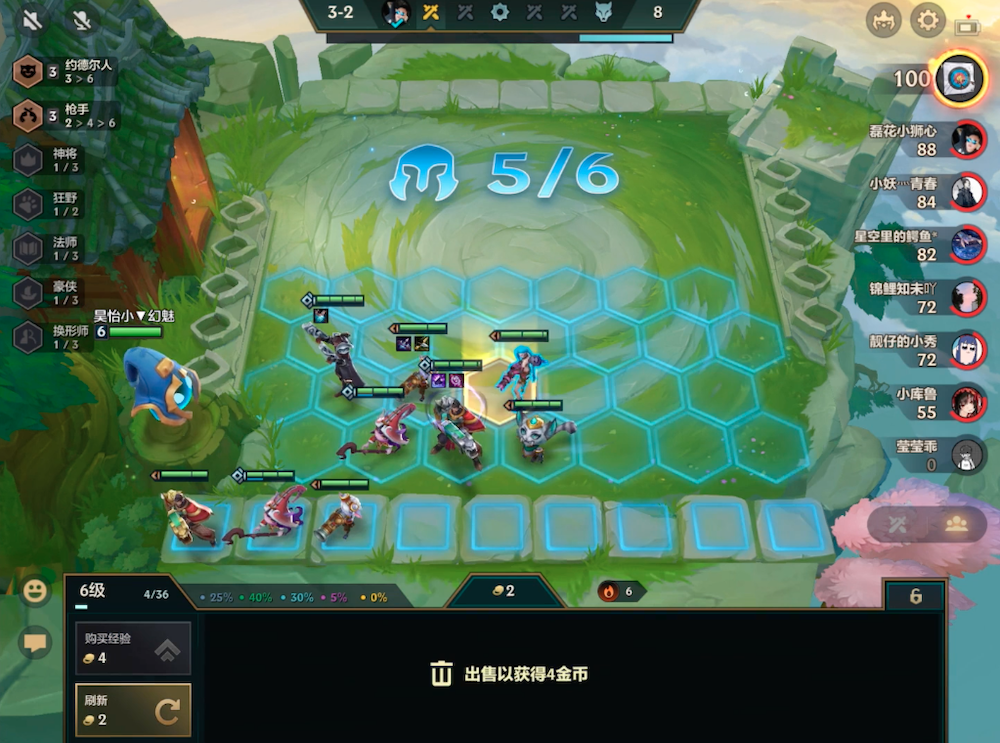

To everyone else: “auto chess” refers to strategy games in which players battle each other on a gameboard similar to a chessboard, using a team of characters which they organize on the go from a pool of characters, which they purchase for the duration of the match from a random selection of a few characters, which refreshes between rounds. Purchasing characters between rounds costs in-match currency, and the player must use strategic thinking to decide whether to use that currency to buy new characters, upgrade their existing characters, raise their team size limit, or re-refresh the selection of characters on offer. The player also needs to consider the tactical placement of characters on the game board, as well as the optimal distribution of equipment items between characters.

TFT is a staple of the auto chess games in the West, and its in-game characters and game world stem from the hugely popular MOBA game League of Legends. However, TFT has not been doing that great on the US iOS charts since its launch. The game usually momentarily jumps into the top-grossing 200 when a new season of the Battle Bass is launched, after which it sinks back into the top 1000.

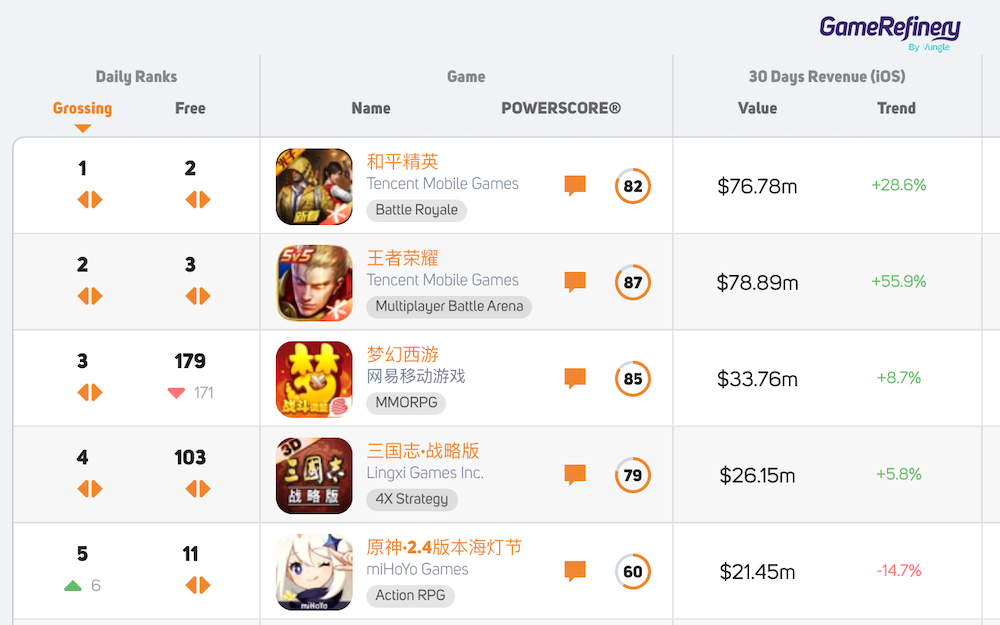

But when TFT was released in China, something surprising happened: the game immediately jumped into 3rd place of the iOS top-grossing charts – a highly contested seat usually reserved for the likes of PUBG Mobile, Honor of Kings, or whichever 4X strategy game or MMORPG happens to be in fashion that day. Worth noting is that TFT was released under a different ID in China: “Battle of the Golden Spatula” (a direct translation of the game’s Chinese name 金铲铲之战) with Tencent as its publisher. After its launch, “Golden Spatula” has still been doing quite well in the top-grossing charts, usually ranking around 10th place depending on the day.

Overview & gameplay

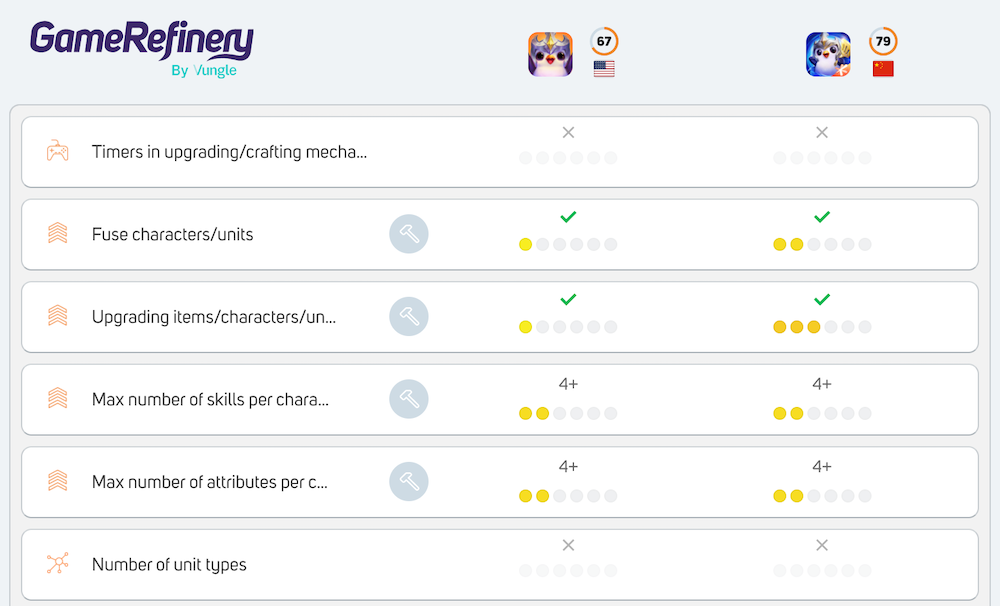

Although released under a different ID than the original TFT, “Battle of the Golden Spatula” is at its core the same game as TFT. The biggest differences lie in content volume, LiveOps, and monetization – Tencent has big resources, and it operates its games in a big way.

However, when you start “Golden Spatula,” the first thing you notice is the high-quality visuals. The graphics have received a slight facelift, and the game features a high-quality 3D opening animation. The menu design is simple, modern, and visually pleasing, with an interactive element to it, which increases the feeling of ownership of decorative items for the player – the focus of the view is whichever character skin the player has currently in use, flying in the air in 3D and viewable from all angles by swiping the screen in any direction. Following the player are a bunch of other characters, which are, in essence, clickable ads for the current in-game event gacha from which you can purchase the skin in question.

When it comes to game content and gameplay differences, “Golden Spatula” featured a large variety of different game modes from the get-go. Apart from the standard version of TFT gameplay called “Dawn of Heroes” at the time, the game also featured the “Crack in Space-Time” game mode, which had similar in-game mechanics to TFT 1.0, which according to netizens, was easier for new players to get into. In addition, the game also included a “Quick Mode,” which used Dawn of Heroes mechanics but with shorter matches, as well as a “Duo Mode,” which divided the players into two four-player teams fighting each other. Furthermore, the game also included two different event-only game modes: a PVE boss challenge mode and the “Equipment Carnival” limited-time-only PVP mode with slightly altered game mechanics.

Apart from the great variety of gameplay content, player engagement was also enhanced with the presentation of the most central progression and reward system of the game: the dynamic PVP league seasons. The player’s ranking in the league is presented in a separate menu with a clear, linear representation of all the tiers in the league and the corresponding rewards for advancing in tiers. The menu also included a hard-to-miss preview of the PVP season’s main reward, as well as the reward for each tier-specific mission. Two separate tier systems existed for the main game mode and the quick mode.

Player engagement was further increased with a lively LiveOps schedule, ranging from various smaller task-based events and new player’s events to limited-time-only game modes and their related reward systems. In its LiveOps calendar, the game also featured not only one, but two Battle Passes: the main Battle Pass with a 10-week duration and a longer progression with various cosmetic rewards, as well as a secondary Battle Pass which lasted only seven weeks, but was both cheaper and easier to complete.

Apart from the Battle Passes, another LiveOps feature increasing both engagement and monetization in “Golden Spatula” were the various limited-time gachas containing exclusive “Little Legend” skins available only for a certain period. The gachas of the game included impressive 3D visuals and various special mechanics, such as the box gacha mechanic, the pity system, and in-gacha shops, making for a more compelling purchase than just buying a boring “chest” from the same old in-game shop. The “FOMO” of the limited time gachas combined with the enhanced feeling of ownership of skins due to the menu/UI design of “Golden Spatula” further increase the overall attractiveness of the cosmetics system as well increasing the sense of value for the player.

Why is it so successful?

When answering the question about the reason behind “Golden Spatula’s” success in China, apart from looking at the compelling gacha design, high variety of gameplay, enhanced ownership of cosmetics, and vigorous LiveOps, one also needs to consider that the brand value of League of Legends is extremely high in China, even higher than in the West. For a number of reasons, ownership by Tencent being one of them, League of Legend has been a national favorite of PC gamers in China for decades at this point (yes, decades), with around 75 million monthly unique players in the country still today, dwarfing any other region or country in comparison. That’s a big and highly potential fan base to market “Golden Spatula” based on the same IP as League of Legends.

Another China-specific factor in play here is the fact that, for various reasons, the Chinese mobile gamer audience is a lot less “casual” than in the West, meaning that a mobile game like TFT/”Golden Spatula” is far more likely to make it big in China. The Chinese iOS Top Grossing chart is living proof of this, as the top ranks are almost completely saturated with extremely time-consuming and complex mid-core games, like 4Xs and MMOs.

Another factor in the Chinese mobile gaming space that probably influences the success of “Golden Spatula” is the fair gameplay experience it offers. The Chinese mobile game space is chock full of “pay-to-win” games, and Chinese gamers are often described in the West as being “more tolerant” towards pay-to-win elements than Western gamers. Looking at the Chinese iOS top-grossing chart, this is probably at least partly true, but it is not the whole picture. There is a constant demand for fair games also among Chinese gamers, and this can be deduced from the one true constant of the Chinese mobile games market: Honor of Kings is (practically) always number one of the top-grossing charts. Honor of Kings is a MOBA game that has been the favorite of Chinese mobile gamers for years, with a fair gameplay experience and monetization mechanics that do not affect the balance of PVP gameplay. The same can be said of the games that have a tight hold of the 2nd and 3rd places in the ranks at the time of writing: League of Legends: Wild Rift and PUBG: Mobile. The fact that all the top 3 positions of the Chinese charts are held by fair, high-quality games should speak volumes. And that is also exactly what “Golden Spatula” is – a fair, high-quality game.

However, even if you have a fair, high-quality game in your pocket ready to be released in China at a moment’s notice, I wouldn’t get too excited. Acquiring the necessary publishing license in China is notoriously difficult nowadays, with waiting times for foreign publishers being counted in years according to the internet. This is where Tencent comes in. Tencent’s connections and local know-how obviously play a big role in the successful release of “Golden Spatula” in China, not even mentioning the sustained success of the game on the charts. According to Chinese netizens and online conspiracy theorists, the fact that the release was even possible at this schedule was thanks to Tencent cunningly publishing it as a completely different game – “Golden Spatula” instead of Teamfight Tactics. The fact that the game was published under a different ID made it possible to claim it was actually a Chinese game that was only utilizing the official LoL/TFT IP, meaning that as a domestically produced game, it could skip the year-long queue reserved for foreign games applying for publishing licenses. Yep, life’s not fair. However, if you compare the two games using our “Compare Games” tool, you will notice that the differences are mostly superficial, and the core game remains the same.

Another way that Tencent’s local know-how undoubtedly helped “Golden Spatula’s” monetization was the way the cosmetics in the game were localized. TFT and “Golden Spatula” completely rely on cosmetics when it comes to monetization, and the most important of them are the “Little Legends” or player character skins. In addition to selling the same Little Legends as the international release of TFT, “Golden Spatula” featured a wide range of new, localized Little Legends available only in China. These included, for example, pandas, mythical Chinese creatures, and cool warriors designed according to Chinese esthetics, which were all sold through the hard-to-resist gacha systems described at the beginning of this article. Another good example of a game that found success after being localized to the market is the Japanese version of State of Survival – see our Japanese market analyst’s analysis of the game here.

Blueprint to success

Although “Golden Spatula’s” high-quality graphics, rich gameplay content, impressive visuals and complex design of gachas, high-frequency LiveOps, and so forth are all good features on their own, they are nothing unprecedented at the top of the Chinese iOS charts. It could be said that they are almost must-have features in the Chinese mobile game space full of vast, content-rich games not that common on mobile in the West. This brings us back to the importance of the League of Legends brand in China, the resources and local know-how of Tencent, and the fairness and high quality of the gameplay of “Golden Spatula” in a gaming landscape full of money-grubbing titles wishing to squeeze the player and only offer a re-skinned variation of the same old turn-based RPG or MMORPG gameplay in return. “Golden Spatula” is just a good fit for the Chinese market, with the necessary features to make it profitable, period.

If you enjoyed reading this post, here are a few more you should definitely check out: