It’s hard to forget the release of Pokémon GO in 2016. Niantic’s AR-based mobile game took the world by storm and broke numerous world records, including the most revenue grossed by a mobile game in its first month ($206.5m). Follow-up attempts at replicating the success of Pokémon GO by integrating AR mechanics into other IP-based games were met with disappointing figures, resulting in job losses and sudden cancellations. But their latest release, Monster Hunter Now, appears to have finally hit the mark.

Based on Capcom’s massive Monster Hunter franchise, which has collectively sold more than 94 million copies over various platforms and iterations over the past two decades, Niantic’s latest title was off to a good start. The game maintained a position within the top 100 highest-grossing apps in the US during its initial month of release, reaching its peak when the event boss Diablos was introduced on the weekend (keep reading for more details on these boss battles). While it has since settled within the top 200, the achievement remains noteworthy, especially when compared to the company’s prior title, Peridot, which, although briefly ranking in the top 200 upon release, quickly fell out of that tier.

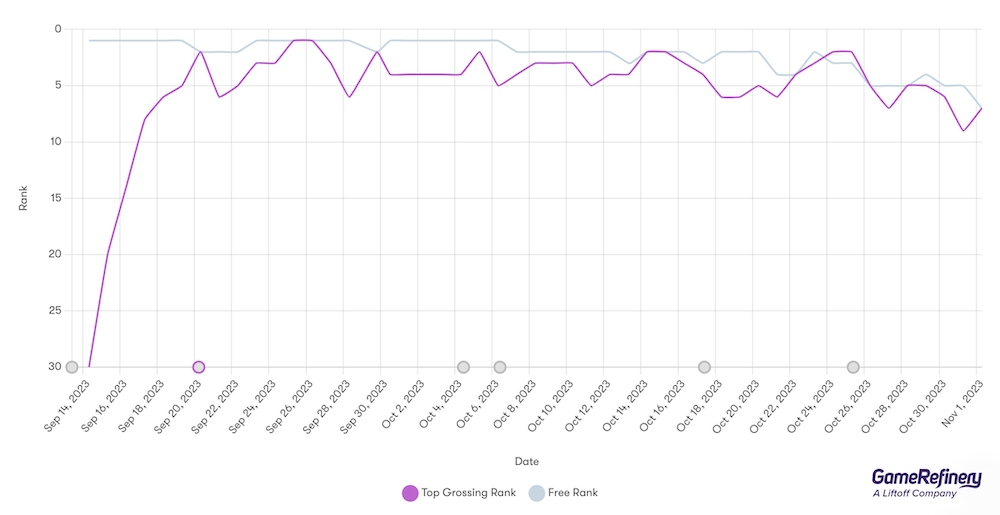

Monster Hunter Now is much more popular in Japan than it is in the US, where it’s been hovering around second place in the download charts since its launch. The game jumped to the top 10 in grossing ranks and reached its highest spot around a special in-game event focused on the Diablos monster on 20 September, which caused daily revenue to increase by almost 300% in the days that followed. This isn’t surprising as, historically, the Monster Hunter IP has been significantly more prevalent in Japan than in any other part of the world. For example, one of the series’ best-selling installments, Monster Hunter Freedom 3 (2010), sold 4.9m units over its lifetime, with over 4m of those sales coming from Japan.

This can be attributed to the franchise having almost always been based on portable gaming platforms, such as the Nintendo 3DS or the PlayStation Portable (PSP), which are more widely adopted in Japan, as many people use them to pass the time on their daily commute on public transport through densely crowded cities. The franchise also built on that large user base through local multiplayer, which brought all the fans together to become a cultural phenomenon.

It’s worth noting that the regional divide has lessened in recent years, with the success of recent titles like Monster Hunter World, which was released on home consoles rather than portable platforms, making it a more recognized IP among Western audiences, largely explaining Monster Hunter Now’s success in the US.

Overview of Monster Hunter Now

Of course, there’s more to Monster Hunter Now than just brand power. It’s an entertaining game in its own right, revolving around solid tapping and swiping controls that players must master to succeed. Tapping the screen performs a basic weapon attack while holding it results in different effects based on the selected weapon. For example, when using the sword and shield, tapping results in a sheathing dash attack, and holding brings the shield up for defense. Players can also swipe the screen to dodge, which provides a special attack boost if timed correctly.

These mechanics come into their own against Monster Hunter Now’s bosses, which are stronger enemies that players can take on solo or with a party of up to four hunters. These bosses each have different difficulty ratings that indicate their level of challenge. Defeated bosses drop material items, which are used to forge and upgrade equipment sets based on the monster they were attained from, a mechanic derived from mainline Monster Hunter titles.

In terms of progression, players unlock new boss monsters and difficulties through a linear task system. They receive an “Urgent Quest” detailing a new boss, which they must defeat in battle on their own. Once they’ve felled the monster, it appears in the wild, where it can be hunted for material items. A new urgent quest will also appear, which players can take on once they feel suitably prepared.

While the game can be played solo, most players will eventually seek the help of other monster hunters once they start to take on higher-ranked bosses. This is because all boss battles must be completed within an allocated time, and it can be difficult to deal enough damage on your own. Thankfully, it’s easy to get a full party because there are no restrictions preventing players from joining boss hunts they’ve not yet unlocked on their own.

World exploration works differently in Monster Hunter Now compared to Pokémon GO. On top of the standard neutral area, Now also features three randomly placed habitats: Forest, Swamp, and Desert. Each habitat shuffles around daily and features unique bosses and materials, encouraging players to explore. Material Spots, Monster Hunter Now’s version of Poké Stops, also update more regularly at every three minutes, compared to five.

Regarding monetization, Monster Hunter Now is surprisingly limited on this front, with just a couple of starter bundles and a selection of consumable boosts. Comparatively, it’s much more difficult to progress in Pokémon GO without IAPs, as players need to buy more Poke Balls to carry on playing once they’ve run out of nearby PokéStops. There are also raid boosts, exp boosts, accessories, storage expansion upgrades, and so much more.

That being said, once players hit higher levels in Monster Hunter Now, unique materials are required to upgrade gear, which can only be obtained from challenging boss fights or via in-app purchases. More detail on how this works can be found in our complete analysis of Monster Hunter Now.

Why location-based AR games are more popular in Japan than in the West

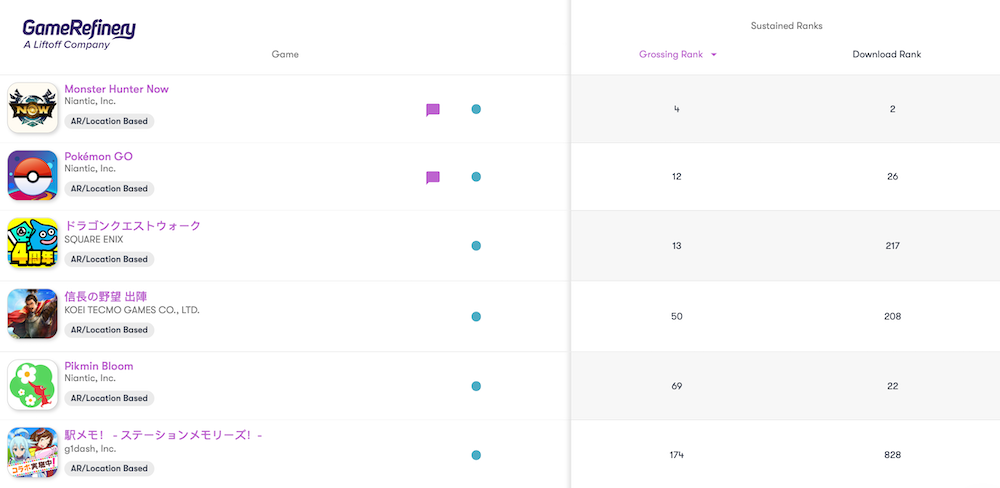

Monster Hunter Now’s success is part of a wider trend; the rise of location-based games in Japan. To put that in perspective, there are three AR titles frequenting the top-grossing 20 in Japan: Dragon Quest Walk, Pokémon GO, and Monster Hunter Now. Moving slightly further down the ranks into the wider top 200 reveals a few more: Pikmin Bloom, Eki Memo, and a new Nobunuga 4X game.

These titles are able to coexist because they each cater to wildly different audiences and their motivations through their unique gameplay. For example, Monster Hunter Now’s mixture of skill-based gameplay and epic monster battles appeals to Thrill-seeking players. Pokémon GO and its expansive library of hundreds of rare creatures stand out to Treasure Hunters. Pikmin Bloom, meanwhile, is relaxing and therapeutic, with players collecting seeds to grow new friends; this appeals to Thinkers who want to take their minds off the outside world.

Looking ahead, Japan’s fascination with location-based gaming is set to continue as Square Enix recently unveiled their upcoming title, Kingdom Hearts Missing Link, described as a “GPS Action RPG,” slated for a 2024 release. While specific details about the game are still under wraps, it seems that real-life locations will play a significant role in its gameplay, further fueling the trend of location-based gaming in Japan.

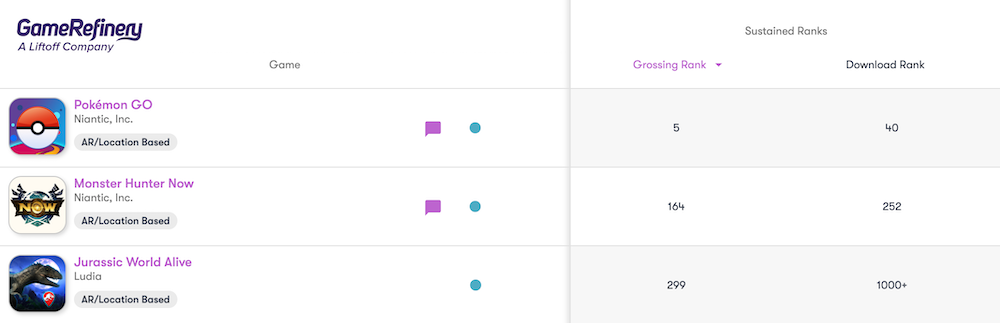

Comparatively, looking at the US market, the only top-grossing 200 AR-based location titles there are Pokémon GO and Monster Hunter Now. Outside the top 200, the best performer is Jurassic World Alive. This difference can largely be explained in the same way as the success of the Monster Hunter IP as a whole.

It’s all down to lifestyles. In Japan, most people have no choice but to commute using public transportation, and location-based games are a good way to pass the time on the journey. In the US, a lot of people have the luxury of their own car, meaning they have the convenience of being able to drive to and from work. The offset of that convenience is that for most people in the US, it means going out of their way to play, such as by walking to work instead or wandering out on their lunch break, and this has seemingly stifled the success of the genre.

Another key factor behind their success in the region is brand awareness, with almost every single one of the top-grossing location-based AR games being based on an established Japanese franchise, each of which brings something unique and engaging to the format:

- Monster Hunter and Dragon Quest are some of Japan’s biggest video game franchises, and each caters to different RPG players. Monster Hunter is for action-oriented fans, while Dragon Quest appeals to those who enjoy turn-based gameplay.

- Pokémon is an almighty IP that works for any audience, regardless of age or background. It’s a natural fit for the genre, as players get to walk around and live the experience of being a Pokémon trainer.

- Pikmin Bloom is a newcomer and ties directly into the recent release of Pikmin 4 on Nintendo Switch, which has rapidly become one of Japan’s best-selling games. The original trilogy has also recently been re-released on the Nintendo Switch.

- Eki Memo is a slightly unusual addition as it isn’t based on a consumer brand. However, the character’s designs are based on existing train models, and visiting train stations is central to the game’s progression, appealing to train enthusiasts.

- A new location-based 4X game released in Japan at the end of August. While this is an unusual genre for location-based gameplay, it has the benefit of being based on Koei Tecmo’s “Nobunaga’s Ambition” series to attract a wider audience.

Can Monster Hunter Now stand the test of time?

The big question mark hanging over Monster Hunter Now is its longevity. Niantic’s Harry Potter: Wizards Unite had a similarly successful launch in 2019 with over 6m downloads but was shut down just two years later due to its consistently poor performance. What’s to say Monster Hunter now won’t meet the same fate once the initial hype has passed?

The big difference between Monster Hunter Now and Wizards Unite is that this title is more respective of its source material, which stems from a lengthy four-year development cycle with Capcom. Players follow the same monster slaying, armor crafting cycle as they do in Monster Hunter’s popular console titles, such as Monster Hunter World and Monster Hunter Rise, except with a location-based spin.

Comparatively, Wizards Unite simply didn’t go far enough to distance itself from Pokemon GO and make the most of its source material, with a big focus on merely collecting magical creatures rather than battling evil wizards and casting elaborate spells. There’s also the matter of Niantic’s Peridot, although the lackluster performance of this title likely relates to its risk as a new IP.

And yet, while we believe this means the game has a sound basis on which to grow, it’s unclear whether the gameplay loop of hunting the same bosses over and over to upgrade specific equipment will be as successful on mobile as on console. That success will largely depend on Niantic’s ability to keep players motivated through an engaging LiveOps strategy; we’re excited to see if they can pull it off.

If you are interested in a more detailed breakdown of features in Monster Hunter Now, be sure to check out our full analysis in the GameRefinery service. You may also enjoy some of our other content based on popular mobile titles:

- A blog post examining how mobile games are using blockbuster movies, such as Barbie and Across the Spiderverse, to boost engagement

- Episode 48 of our podcast, the Mobile Games Playbook, is about Pokémon Sleep.

- Our 2023 Midcore Gaming Apps report includes information on the latest trends and revenue-boosting opportunities across midcore mobile games.