It’s been a long time coming, but Dream Games’ Royal Kingdom finally made its long-awaited debut in November after a significant soft launch period. Given the immense popularity of the title’s predecessor, Royal Match, many are wondering how the title might disrupt the norm. It has not quite smashed its way to the top of the grossing charts, but early results suggest it is slowly but surely climbing up the ranks.

Royal Kingdom wasn’t the only long-awaited arrival in November either, as we also saw the debut of the second season of Arcane (based on League of Legends) on Netflix. League of Legends developer Riot sought to capitalize on the animated series’ immense popularity with a breadth of new content in Wild Rift—including a new battle pass, a themed PvP event, an assortment of new cosmetic options, and more. It paid off too, with the game seeing a notable spike in downloads.

Meanwhile, Diablo: Immortal launched a crossover with another renowned Blizzard franchise, World of Warcraft, which just celebrated its 20th anniversary. It was a notable month for Genshin Impact too, which expanded its popular card-battling minigame Genius Invokation to incorporate auto-chess. While an innovative addition, it’s unlikely to knock Pokémon TCG Pocket off its pedestal, which continues to dominate the rankings, particularly in Japan.

Below, you’ll find more on these games and updates, as well as the latest events and trends from both the casual and midcore markets.

November’s casual game updates

Who says less can’t be more? Match3 is usually the genre that comes to mind when discussing puzzle games dominating the mobile charts, but last month, two notable titles switched their attention to merge2 instead.

Leading the charge was Piggy Kingdom’s Merge Wonders event, which combined both match3 and merge2 elements. First things first, players had to beat Piggy Kingdom’s regular match3 levels to earn special boxes. Each box contained random items that players could combine to complete various tasks, which in turn would award them points.

These points could be spent to open up space on the game’s merge2 board, which was almost completely locked down at the beginning of the event. Players would receive event items as they unlocked spaces, but the key rewards—such as in-game boosters and in-game currency—were specifically tied to unlocking chest tiles on the grid.

Lily’s Garden also implemented a merge2 minigame last month, Lily’s Merge, which had some similarities with the merge events that Playrixes ‘scapes games used to run. The main difference in Lily’s Garden’s approach was its monetization, incorporating a mini-battle pass with a free and paid premium track. The game also introduced an event titled Lily´s Tasks with simple daily task completion mechanics, which are a rarity in match3 games.

Overall, it was a significant month for Lily’s Garden live events cadence, with four interconnecting major events in the game running simultaneously during November: the Seasonal Collectibles Album, Makeover Time, Lily’s Tasks, and Lily’s Merge.

Meanwhile, Coin Master introduced a new minigame that diversifies gameplay and enhances player engagement. In Wildland Adventure, players are presented with an exclusive multi-level adventure map, where they use potions to interact with obstacles and unlock rewards. The event also features unique mechanics for generating and managing event energy in the form of the upgradeable Tree of Life, which generates potions over time.

The game also introduced a new guild-based PvP competition mode, Team Battle, where players compete to destroy an enemy base by collecting and using barrels to damage enemy structures. The first team to destroy all the enemy items or accumulate the most barrel points was awarded a grand prize—a bundle of event currency and pet food, plus a chest.

Lastly, Candy Crush Saga launched possibly the sweetest IP collaboration event we’ve seen yet, with a brand new season inspired by Nestle’s KitKat. The new season introduced alternating collection and tournament events, where players had to obtain as many red KitKat candies as possible to hit certain collection milestones or win the competition (both of which would award in-game boosters).

Additional casual gaming highlights and other news

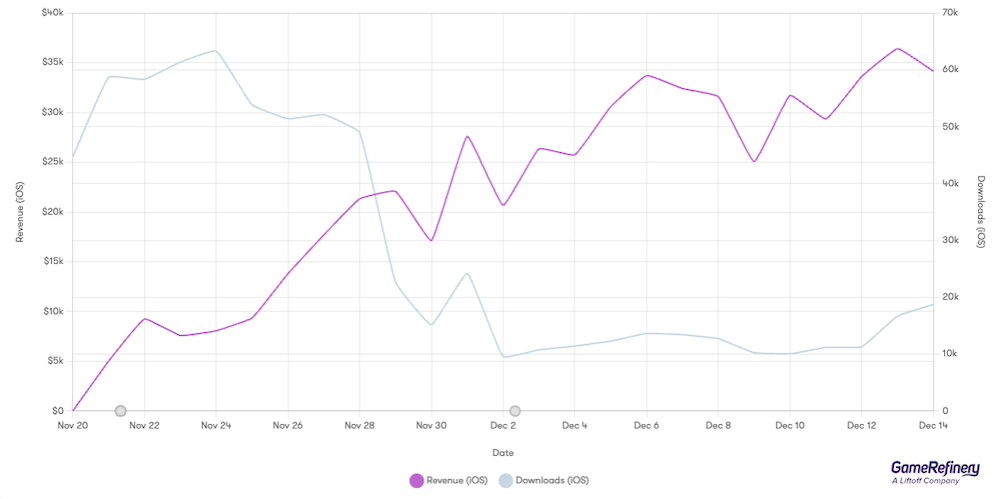

After spending more than a year in its soft launch period, Dream Games’ Royal Kingdom, the successor to Royal Match, officially released onto the mobile market on 21 November. The final product has changed somewhat since it first became playable in April 2023, going through multiple iterations. For example, it originally featured multiple PvP elements that ran simultaneously, a feature that has since been scrapped.

The main difference between Royal Kingdom and its predecessor, Royal Match, lies in the introduction of Kingdom levels—PvE boss battles that occur every five levels. These take a lot of inspiration from the puzzle RPG Empires & Puzzles, with players challenged to ‘defeat’ enemies and complete objectives by making matches that trigger ‘attacks.’ Beyond that, the two are largely similar, and it remains to be seen whether this single differentiator will allow it to co-exist with Royal Match.

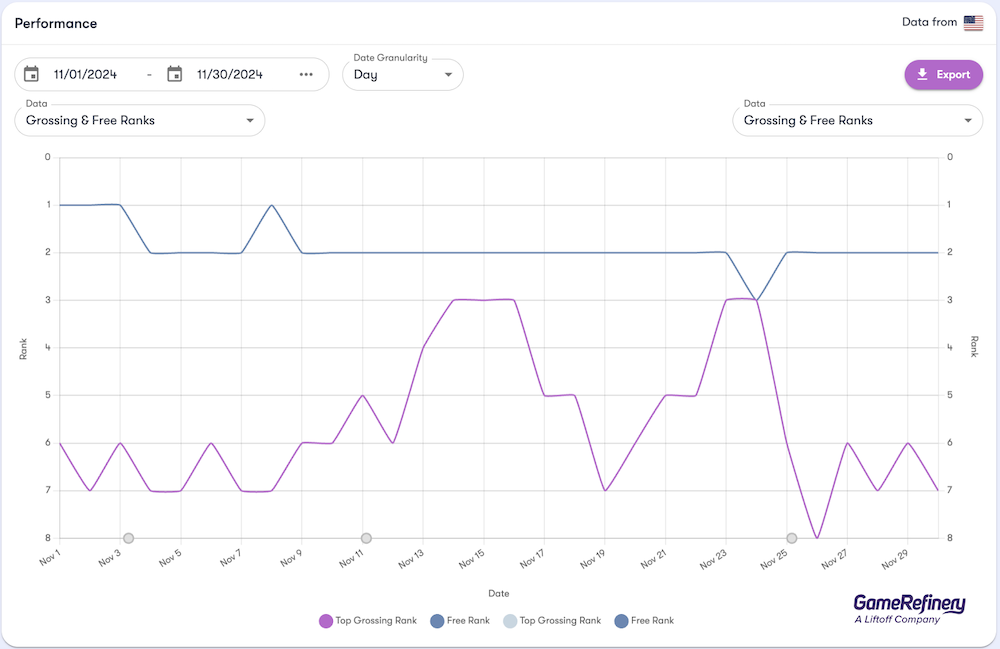

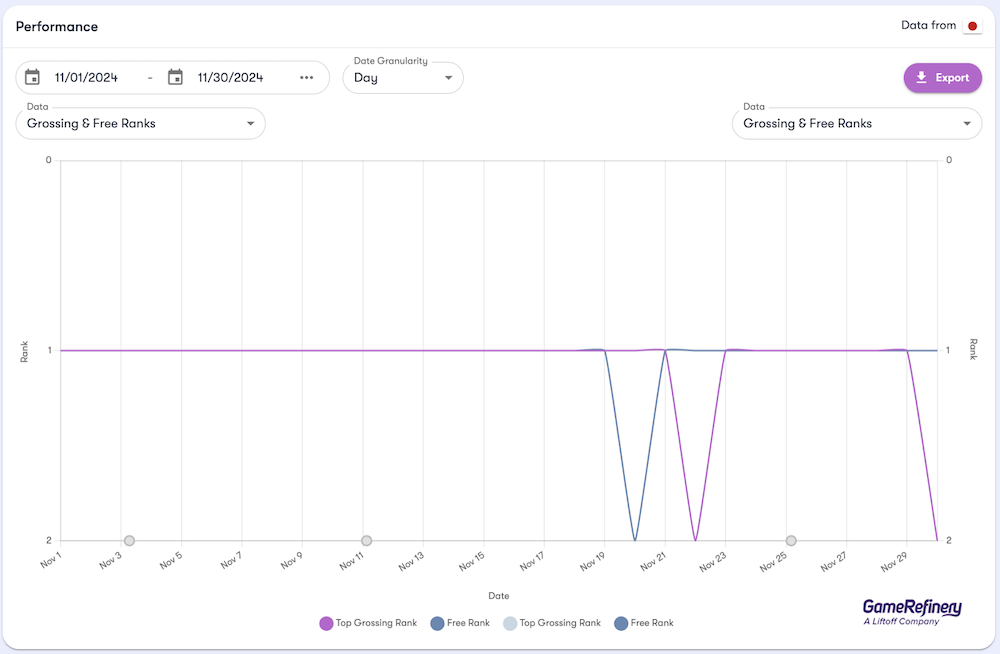

Looking at its success so far, Royal Kingdom didn’t shoot straight to the top of the charts, but it has seen a steady improvement in its revenue performance every day since its launch, while downloads have slowly fallen. Daily revenue has increased by over 500% in just three weeks, while downloads have decreased by over 75%. Given that Royal Kingdom is a casual game, this pattern isn’t unexpected, as most titles in this category focus on bringing in new users at first. Monetization only becomes important when players have progressed onto more challenging content further into the game.

The capybara craze continued in November with the global launch of HABBY’s Capybara GO!, which has stayed within the US top-grossing 100 and top 50 downloads since its launch on 20 November. In the October Analyst Bulletin, we wrote much about how the title follows the tried and tested HABBY “recipe” of mixing roguelike elements with casual gameplay. Check it out to learn more about the game’s mechanics and robust LiveOps framework.

November’s midcore game updates

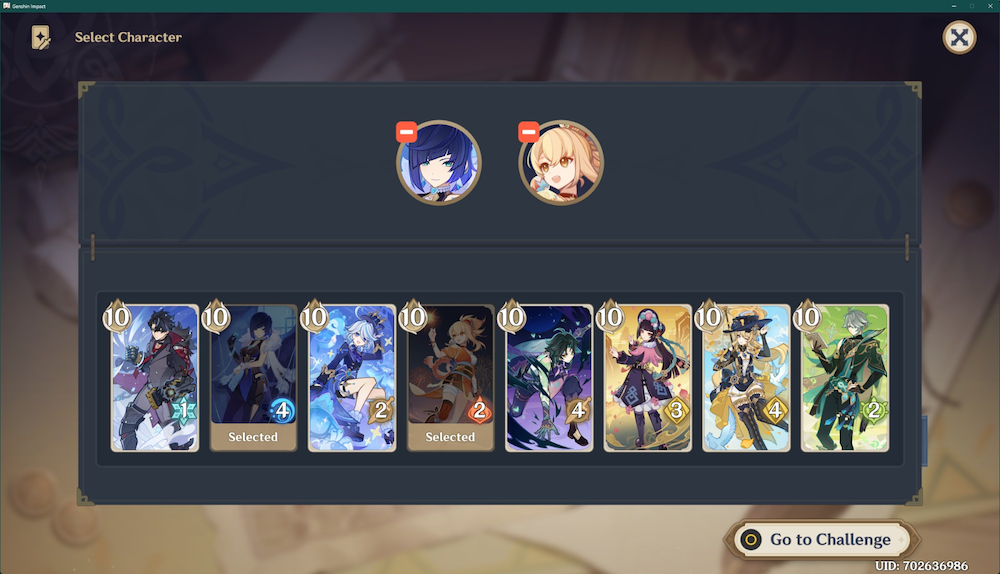

Genshin Impact is the latest mobile title to be inspired by the oldest board game in the world: chess. Heated Battle Mode: Automatic Artistry is an unusual amalgamation of auto-chess gameplay and Genshin Impact’s existing trading-card game, Genius Invokation.

In the mode, players assemble a deck of character cards and then battle to see who has the best team. At the start of each game, which consists of several rounds, players choose two characters from a random list who they’ll use for the whole match. From there, players choose one Weapon (offensive abilities) and one Artifact (defensive abilities) to equip onto their chosen characters at the start of each round.

As the mode is auto-chess, the actual battles take place automatically. Going from left to right, all the characters in a match take turns to become ‘active,’ during which they’ll attack the opposing team. After all the characters have attacked, the left-most character becomes active again—this continues until one of the players loses by having all their characters defeated. Whoever wins is awarded Lucky Coins, which are used in the TCG in-game shop to purchase new cards.

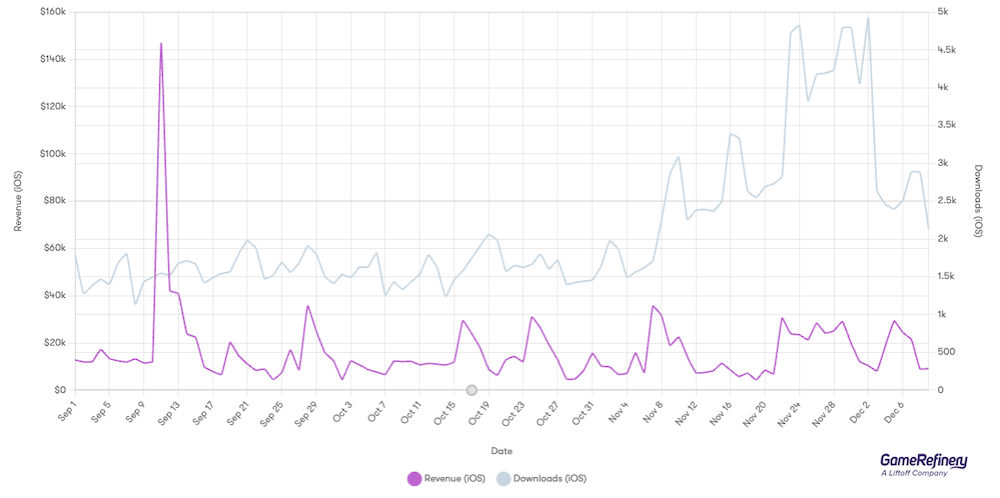

When it first appeared in 2021, the first season of Netflix’s Arcane animated series based on League of Legends was viewed over 34 million times in just six days. Last month, the second season was finally released, and its popularity has seemingly only increased with time, with it hitting the top spot in over 61 countries worldwide. Riot Games, the developer behind the League of Legends franchise, saw an opportunity to capitalize on the launch of the new season across its portfolio.

Given that they share the same universe, it should be no surprise that League of Legends: Wild Rift (and League of Legends itself) had the most substantial offering, although there was also content in Teamfight Tactics and Valorant. Wild Rift released a selection of celebratory events under the Cheers to Arcane banner, which were tied together via season-exclusive “Keys of Inequity” event tokens that could be exchanged for unique rewards in an event shop.

The events included the Arcane Pass, which rewarded players with exclusive skins, a new event for the character Ambessa, and Battle of Twin Cities—a unique team vs. team event where players choose to fight for either Piltover or Zaun, the locations at the center of the Arcane series. At the end of November, a selection of themed skins was also released, including individual skin bundles, a mega bundle including all the featured IAP offers, and a themed limited Poro Chest gacha.

The crossover and hype surrounding the Arcane series had a notable impact on Wild Rift’s performance. In the US iOS market, daily downloads around 23 November—coinciding with the release of Arcane Season 2: Part 3 on Netflix—were nearly three times higher than October’s average.

Blizzard combined its two biggest RPG franchises with a crossover between Diablo Immortal and World of Warcraft (WoW). In Eternal War, players headed to the Fallen Citadel to fight the Lich King, a well-known enemy from the WoW universe, or battled in Cutthroat Basin, an 8v8 PvP mode set in WoW’s classic Arathi Basin battleground location. The update also added flashy WoW-themed cosmetic rewards, like the Betrayer’s Bond Cosmetic Set. Some of these were attained by simply participating in the event, while others were monetized.

Additional midcore gaming highlights and other news

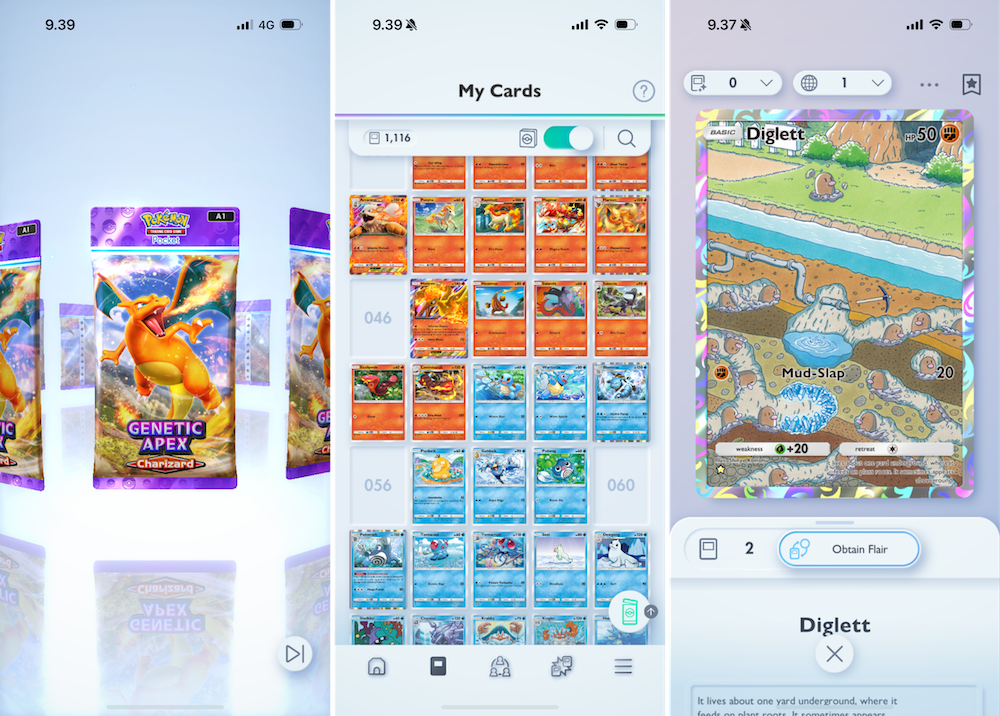

Card battlers have traditionally catered to the midcore market, but Pokémon TCG Pocket has achieved remarkable success by casualizing the genre—shifting the emphasis from competitive battles to the straightforward enjoyment of collecting your favorite cards from booster packs.

That experience resonated with audiences so well that the game has enjoyed unprecedented dominance over the top spot in both the download and grossing ranks in Japan since its launch—a level of performance that surpasses even the likes of Pokémon GO! and Umamusume Pretty Derby. The game has also remained in the top-grossing 10 in the US since launch and within the top three for downloads.

Looking at TCG Pocket’s place among the existing library of Pokémon titles, it’s important to note that most focus on one of two themes based on the franchise’s most iconic catchphrases: ‘I wanna be the very best’ and ‘Gotta catch ’em all.’

Pokémon TCG Pocket, Pokémon Go, and Pokémon Sleep are examples of titles that focus on the latter, and all three have managed to maintain their stellar performance long after release. Meanwhile, more battle-focused titles like Pokémon Unite and Pokémon Masters EX, while still moderately successful, tend to occupy the lower end of the ranks.

Dark War Survival, a new 4X title launched in September, has steadily gained traction. This hybrid 4X game incorporates RPG elements, including an auto-battle mode, a hero collection meta-layer, and a survivor management system. It simplifies certain core mechanics while featuring cartoony visuals that may appeal to casual audiences. Notably, the game introduces unique monetization features, such as multiple battle passes with distinct progression systems.

Another game that has also been growing in popularity is Top Girl: Produce 101, which launched in November and has rested around 130 in the US grossing ranks. As well as being a 4X strategy title, the game features elements from the idol, idle, and sovereign genres. It also heavily utilizes generative AI.