It’s once again time to see what kind of mobile game news our GameRefinery game analysts have prepared for us this month.

In May, analysts witnessed several exciting promotional collaborations, like Godzilla and King Kong’s mobile take over in PUBG Mobile and LifeAfter or Roblox x Gucci collaboration, which exclusive merch might make you break the bank. Moreover, we have some interesting top 200 grossing entrants with very strong starts, especially in the US market, as well as a special gacha mechanic that seems to be all the rage among RPGs in China at the moment. If we’ve gotten your interest, let’s take a look at what happened in the mobile game markets in May.

Check out also our video series based on the Analyst Bulletin called Mobile Games Insider, which provides you a monthly snapshot of the biggest and quirkiest stories from the mobile gaming industry.

US Market Overview

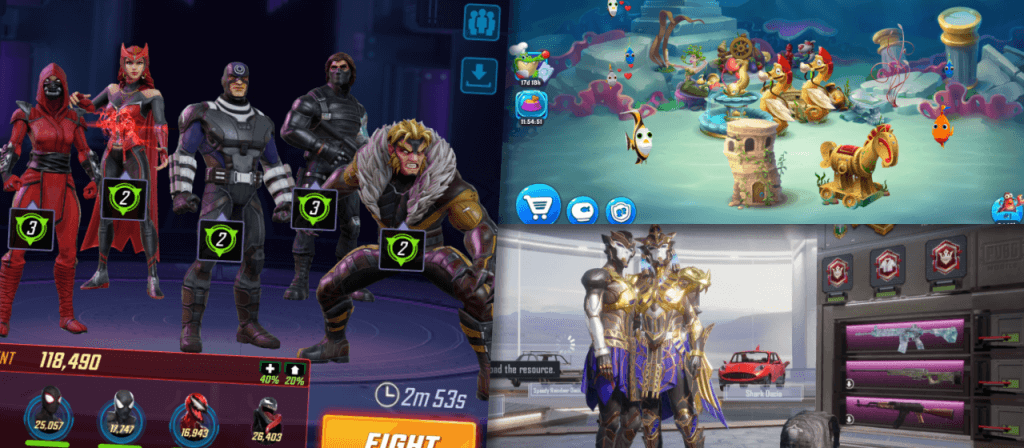

- With Godzilla vs. Kong movie recently out, we’ve seen some Godzilla and King Kong-related mobile gaming news, like LifeAfter’s recent global collaboration with the monsters (more on this in Japan’s market overview part). Now, PUBG Mobile is the latest to join the party with a collaboration that starred both Godzilla and King Kong. These massive creatures appeared on the various Battle Royale maps to wreak havoc. Players couldn’t hurt them, but these monsters could kill players in the matches. While walking across the map during the match, the creatures left behind crystals that players could use (the effects depend on which creature is in the match).

- Genshin Impact had once again a massive update, which main focus goes this time to the new feature addition: Serenitea Pot. Serenitea Pot is a “player housing” feature, which brings new social and decorative elements into the game. The update also included interesting event content, such as the first “competitive/PvP element in Genshin” called Windtrace (prop hunt-style game mode).

- Call of Duty: Mobile had a lot of interesting things happening in its latest update:

- 80s Action Heroes collaboration event allowed players to purchase Rambo/Die Hard bundles to get, for example, Rambo/John McClane skins. The collab event also included a pretty basic limited-time game Free-for-All Deathmatch mode, but the twist is that you’re constantly accumulating “rage.” When the “rage meter” fills fully, you can transform into a super-soldier with two Gatling guns (Rambo or John McClane).

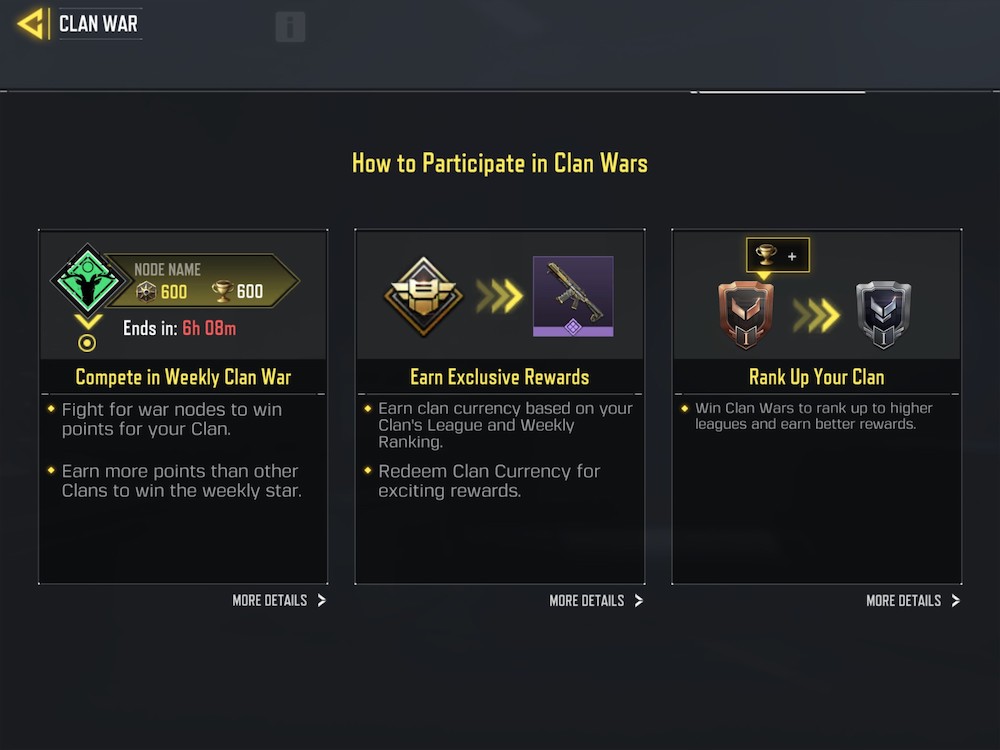

- However, the main interest in this update goes to the new Clan War feature, as it’s very rare for these competitive shooters to bring actual new features into the game (outside events, new limited-time game modes, etc.). The Clan War feature pits six different Clans against each other in weekly competitions, and they compete in controlling various nodes in the Clan War map. Players earn scores for each node by completing specific tasks (e.g., use specific weapons in particular game modes), but they can get bonuses for their score from various things as well (e.g., owning the Battle Pass, playing with friends and not randoms, clan leader can set one “key node” with bonus score, etc.). When the week closes, Clans get trophies accordingly, which dictates their overall Clan ranking for the next Clan War. Each player also gains new Clan currency based on the Clan’s performance over the week. This currency can be used in a new Clan Store to redeem various exclusive cosmetic rewards.

- Moreover, the game added its second incentivized ad placement, which is super rare within the Shooter genre.

- Rise Of Kingdoms had a massive update, including, for example, new PvP mode, new faction, new champions, events, etc. Probably the biggest addition to the game in a while was a new synchronous 5v5 PvP game mode, Champions of Olympia, which has clearly taken a lot of influences from MOBAs with its structure but has still the familiar RoK strategy combat. Another big thing in this update was a whole new faction, Vikings, for players to choose.

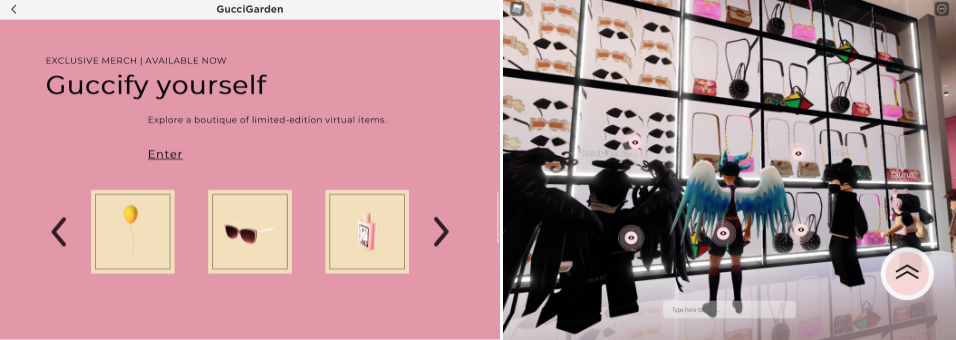

- Roblox had two big collaboration events: Gucci Garden and Zara Larsson Launch Party.

- Gucci Garden event had a Gucci Garden Archetypes game, a multimedia experience consisting of various artistic areas where players can enjoy Alessandro Michelé’s creative vision come alive. The game also featured a Gucci boutique shop with various limited-time Gucci accessories for sale.

- Zara Larsson Launch Party also had its own game featuring Zara’s Swedish lake house, a huge hang-out area with various activities. The house also had a large stage where an exclusive launch party performance by Zara Larsson was held at specific times, celebrating the launch of her new album Poster Girl: Summer Edition.

- Kiss of War’s latest update included an ongoing promotional collaboration event with a famous Japanese adult video actress Kana Momonogi. During this event, players can collect photos of Kana Momonogi in a photo gallery by leveling up your event level using “Photo Albums,” which can be obtained from a daily login gift and defeating “Investigator’s Armories” in the world map once a day.

- TFT: Teamfight Tactics launched a new season, and a new ranked playing mode, “Hyper Roll,” which is a more fast-paced version of a typical TFT match.

- Merge Dragons! got a completely new event type, Den Events, which was first introduced through a beta version in March 2021 to some Dens, but this time everyone got to play! The new features in this event type were, firstly, the communal aspect. In addition to your personal accumulated score, you had the opportunity to join your active Den mates and aim for special reward score thresholds by adding up the shared total score. Secondly, there was a feature called the Wishing Well. As soon as the timer allowed, you could throw in a Wishing Well Coin (level 5 Aureus, you could get these by merging lower level coins) and trigger a ~20 min point from particular randomly decided merge chain objects.

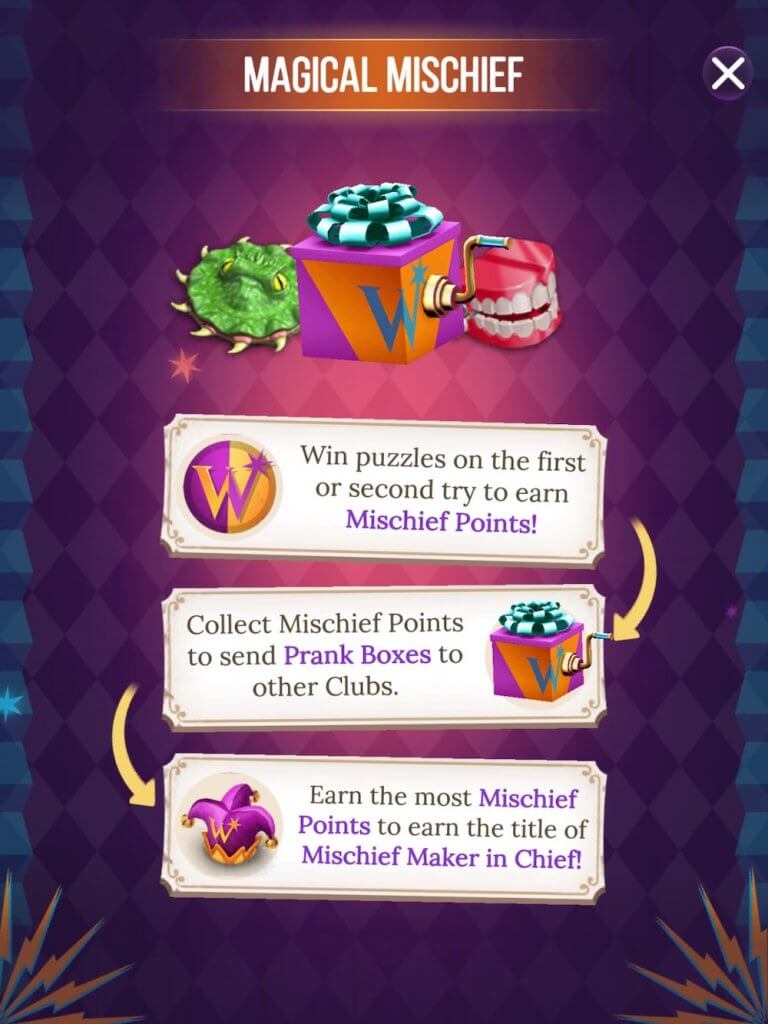

- Harry Potter: Puzzles & Spells added an interesting new type of competitive guild event with win streak mechanics for a Match3 game. Different guilds were pitted against each other in this Magical Mischief event, and points were earned by completing levels on the first or second try. When you got enough points, you could send “Prank Boxes” to other guilds. These boxes reduced opposing guild’s score and made completing levels harder for them.

- Kim Kardashian: Hollywood got squads, i.e. guilds. You can either create a Squad or join an existing one to engage and play with other people. There are a couple of guild-related features available, most importantly guild login task (the more Squad members login daily, the bigger rewards everyone gets), guild communal gift (when someone in your Squad makes a real-money purchase, you get a free gift), and the possibility to “shop” someone else’s look (easy way to get interesting items/accessories to your wardrobe).

- Lords Mobile: Tower Defense got a new independent special playing mode with line defense/real-time tactical combat mechanisms called Vergeway. In this mode, you collect Cards representing various units & spells (e.g., Arrow Tower or Fireball) and use them to clear Vergeway stages (= matches against AI-controlled enemies).

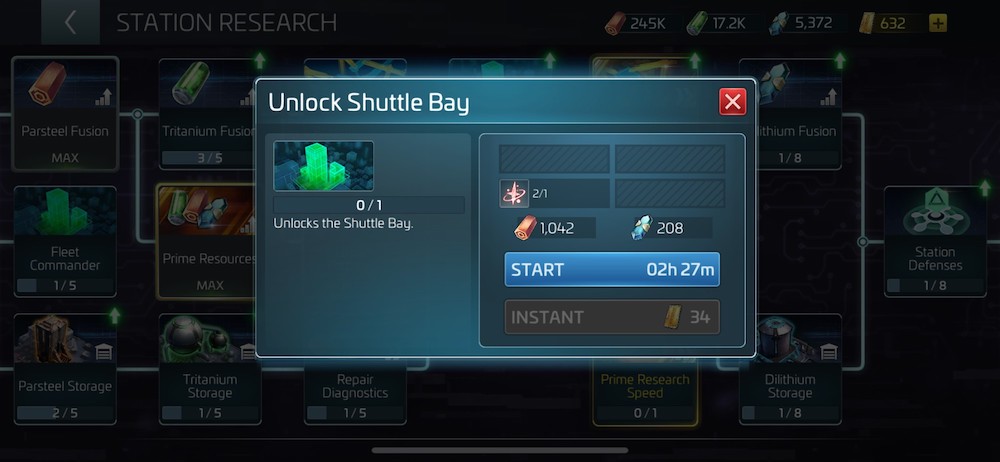

- Star Trek Fleet Command got a new feature called Away Teams, allowing players to collect rewards multiple times a day by assigning Officers to do auto-complete tasks. There’s lots of additional research to be done to boost the efficiency of the Away Teams, giving this feature a lot of depth and making it much more complex than typical expedition features.

- Summoners War added Battle Training Ground, a new PvE mode where players can practice combat and tactics in “mock battles” and win rewards for clearing the battles for the first time. The great thing is that these battles don’t consume energy, so players can try them out as many times as they want.

- Board Kings got a new sticker album titled Bunnies Through Time. The album has similar mechanics to past albums, but there’s a new jackpot sticker mechanic and a completely revamped look.

Moreover, this year our US analysts spotted a good amount of various Ramadan-themed offers in mobile games in the US market compared to last year.

Finally, this month our analysts have picked the next two games to their list of US top 200 grossing entrants to keep an eye on:

- My Hero Academia: The Strongest Hero is a new Action RPG based on popular anime IP with relatively high production values that has gotten a very strong start in May, peaking at around US top 10 grossing. We’ll be following with interest how the game succeeds to maintain its ranking in the future.

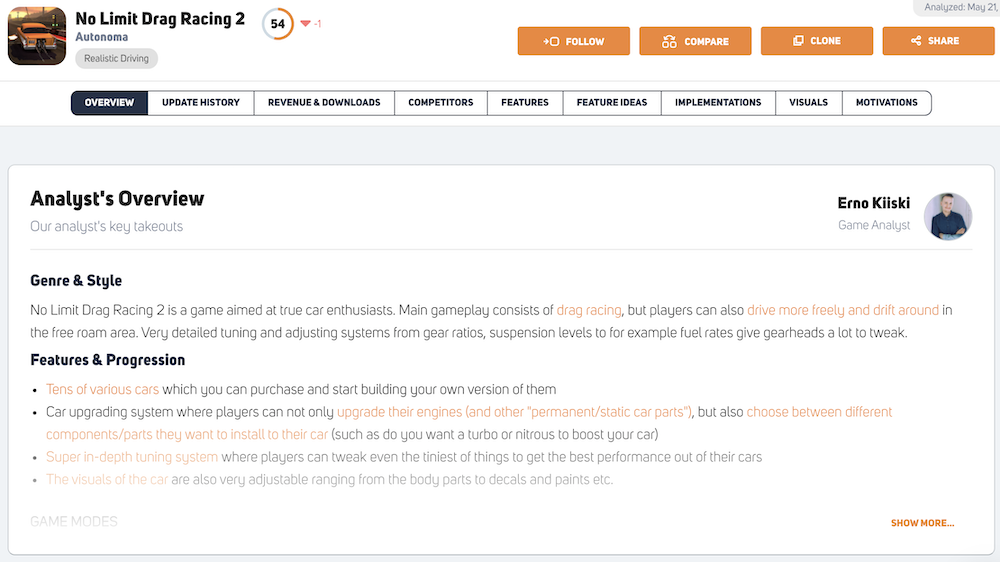

- Another game with a super-strong start is the No Limit Drag Racing 2, especially for a game that’s so targeted to quite a “niche hardcore car audience.”

China Market Overview

- PUBG Mobile (Game for Peace, 和平精英) added a new Among Us-inspired game mode (谁是内鬼), where a team of players tries to complete a set of tasks. However, one of the players is a mole (only public to the mole itself), whose objective is to hinder the team’s work without getting caught in the process. The question is, will there be a similar game mode in the PUBG Mobile global version? If yes, the mode has to come with enough changes to get approved without any copyright claims. Some Among Us lookalikes have come under a lot of scrutiny for the same.

- CrossFire (穿越火线:枪战王者) introduced a new fighting mode (屠龙刀大战金箍) that focuses on close-quarters combat.

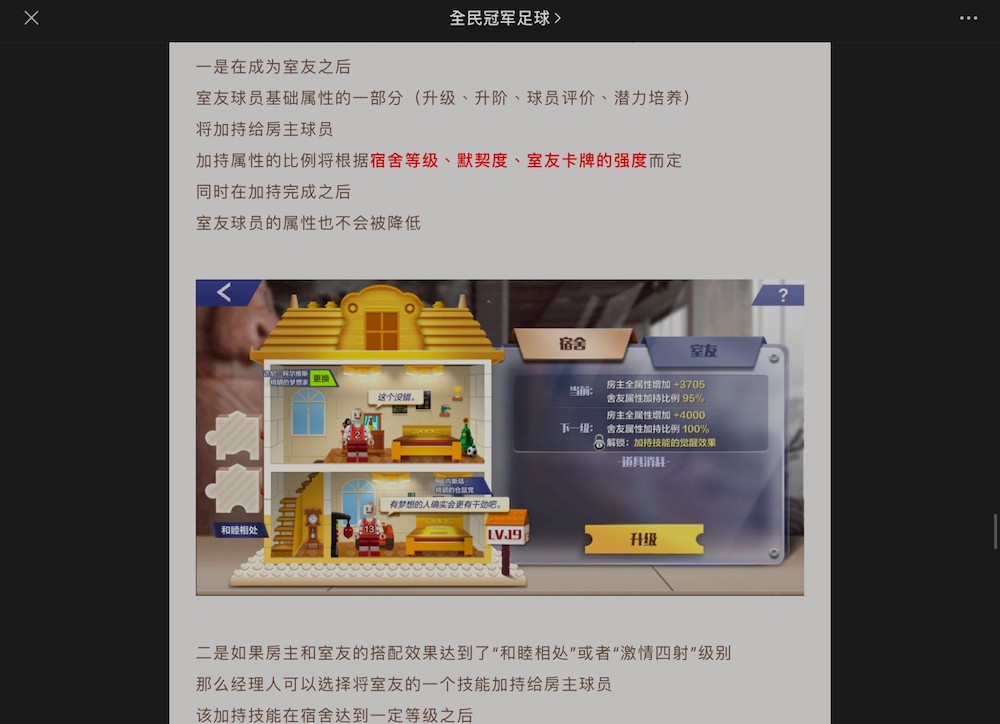

- National Championship Football (全民冠军足球) added a late-game character development system called “Dorm,” in which you can select football players and put them in a dorm to live together. The players have different personality types (two per player), some of which are compatible with each other while others are not. The system is very similar to typical RPG character development systems.

- Merge Tower Defense game Fusion Crush (球球英雄) introduced a new RPG-style permanent boost system called ”天赋,” which includes 12 constellations, each made up of 8 upgradable boosts called 法阵, raising the number of permanent boosts in the game by a total of 96. The big change to the game’s feature set was followed by a nice spike in Fusion Crush’s revenue.

- Character-collector TBRPG Three Kingdoms Fantasy Land (三国志幻想大陆) introduced two new characters in a massive way: Event game mode, 2x special gacha mechanics, incentivized character background story watching, event currencies, and an event shop.

- Punishing: Gray Raven (战双帕弥什) also rides the gacha trend with the special gacha mechanic of the month, which lets players select what they want as the top prize. The update also introduces new characters with a big event with special game modes & background stories, etc.

- Slots GoldenHoYeah-Casino Slot added an auto-loot ticket called “Skip Ticket,” which is unusual for Slots games. Using the Skip Ticket, players can instantly get the rewards of any number of rounds on a slot machine before they hit a special event trigger on any slot machine of their choosing.

- A Music/Band rhythm game based on the Ensemble Stars music game franchise ǒu xiàng mèng huàn jì 2 (偶像梦幻祭2) had a big half-year anniversary, which included lots of giveaways and special benefits.

According to our China game analysts, the current gacha trend among the Chinese market’s RPGs seems to be the gacha, where you can select the character you want as the top prize. For example, games like Three Kingdoms Fantasy Land and Punishing: Gray Raven have utilized this mechanic recently.

From a more general point of view, it has been very quiet in terms of non-Chinese games’ presence in Chinese top-grossing. This is most likely due to the fact that obtaining publishing licenses has become a really laborious and slow process in China, and for games coming from outside China, it can at worst take more than a year to get a license (twice as long as Chinese ones).

In May, China celebrated Chinese Lovers’ Day, which inspired some of the games to join celebrations in the form of Lovers’ Day dedicated events. Moreover, last month marked International Museum Day, and it was nice to see some of the games, like Rise of Kingdoms (万国觉醒) and War and Order (战火与秩序), taking part in raising awareness of the importance of museums with their own IMD-dedicated events. This is also a great example of how these kinds of smaller events provide an endless stream of fresh content ideas if you can find a way to bring the event into the context of your game.

Lastly, new interesting entrants in the Chinese top 200 grossing in May were:

- Pokemon Quest

- Yi Nian Xiao Yao (一念逍遥), “immortal game”

- Solo Knight (独奏骑士), shoot/beat ‘em up

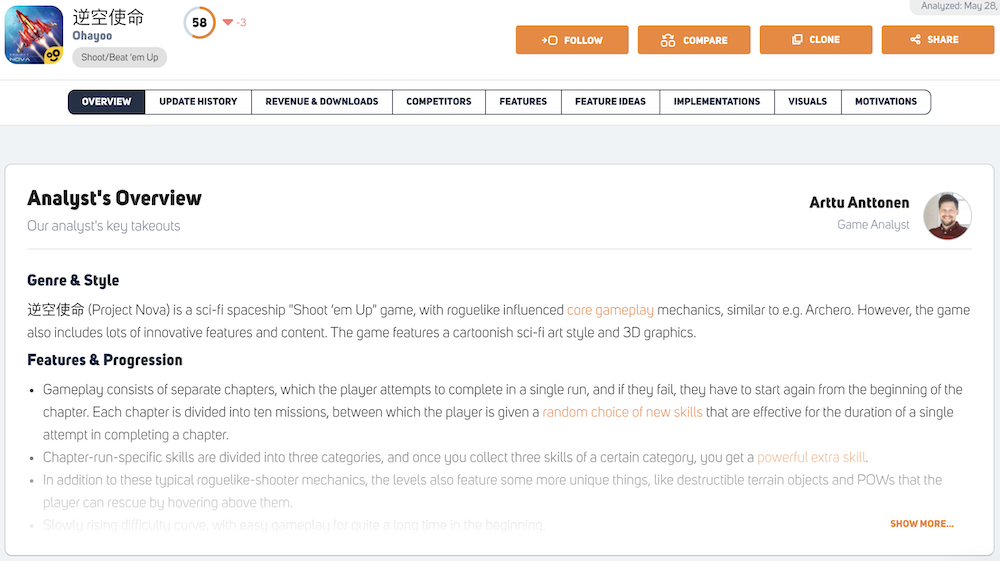

- Project Nova (逆空使命), innovative spaceship shoot-’em-up

- Quan-min Xue-ba, “National Top-student” (全民学霸), school management-themed Sovereign game

Japan Market Overview

- Monster Strike (モンスターストライク) added a new event mode, Real-Time World. Its Battle system is real-time based, which is different from the game’s usual turn-based battle system. Moreover, the game also had a separate collaboration event with the TV anime 呪術廻戦 (Jujutsu Kaisen) during May.

- PUBG Mobile had a Gojira (Godzilla) vs. Kong collaboration event (the same as in the US)

- Youkai Watch Punipuni (妖怪ウォッチ ぷにぷに) had a collaboration event with the magazine Weekly Shounen Sunday. Players were able to get characters from various comics published in Shounen Sunday.

- Wizard’s Promise (魔法使いの約束) celebrated its 1.5 anniversary with an interesting reissue event: players could choose any event from a selection of past events, and they would be able to play the event again. Additionally, the gachas from the event became available. With the update, the game also added its first-ever limited-time IAP offers.

- Japan’s The Seven Deadly Sins (七つの大罪 光と闇の交戦 : グラクロ) follows the US version with a massive Stranger Things collaboration.

- Kotodaman (コトダマン-共闘ことばRPG) collaborated with Puella Madoka Magica and added a Battle Pass system to the game.

- Umamusume Pretty Derby (ウマ娘 プリティーダービー) added a new synchronous PvP mode, which takes the shape of a 3-stage champions meet, where each stage has participation and a time limit. At any stage, players can participate in races inside their chosen difficulty class a maximum of three times per day.

- Dragon Quest Tact (ドラゴンクエストタクト) had a Dragon Quest VII event combined with celebrations for 14 million downloads and Golden Week. The event included, for example, three new characters, an exchange shop, another mega-sized boss battle, a tower challenge, and special challenge missions unlockable with color-coded pieces found through event gameplay.

- PUBG Mobile wasn’t the only game where players got to meet the famous monsters, Godzilla and King Kong. LifeAfter also had a promotional collaboration with Godzilla vs. Kong movie, which included plenty of content starting with a sightings mission at Fall Forest (open to all), team monster challenge for players of battle rank over 10 (pick either King Kong or Godzilla), cross-over investigation mission and several new accessories, outfits, vehicles and spray tags. The same event is currently running in the US and China markets also.

- Nier Re[in]carnation collaborated with Drakengard 3 (known in Japan as Drag-On Dragoon 3.) The event featured a gacha banner for a character called Zero, event shop, quest battles with a storyline, additional achievements, and login bonus.

Meanwhile, Japan’s Golden Week events continued at the beginning of the month. For example, Dragon Quest Tact’s (ドラゴンクエストタクト) Golden Week event content included a login bonus and two gachas. For the game’s download count reaching the 14 million milestone, players could also “challenge” the celebratory battle (basically a gift in battle form), where the enemy was a single slime with 25 HP or so, and the reward was a whopping 1400 gems.

Finally, when we look at new interesting games that have entered Japan’s top 200 grossing list, the following games have caught our JP game analysts’ attention.

- My Hero Academia ULTRA IMPACT (僕のヒーローアカデミア ULTRA IMPACT), turn-based RPG

- ブラック・サージナイト, autobattle RPG

- FUSHO-浮生-, MMORPG with court/romance theme. The game has been on China’s top-grossing list for some time and now finally in Japan as well. If you have access to GameRefinery’s Chinese market data, you can check out analyst’s key takeouts of the game here.

- Moonlight Sculptor, fresh chibi-like visuals for MMORPG

Q&A with the GameRefinery’s Game Analysts

The next interviewee in the Q&A series is GameRefinery’s China’s Market Game Analyst, Arttu Anttonen.

Tell us a bit about yourself and your current role and what it entails?

I have been working at GameRefinery as a Game Analyst for three years now, mainly concentrating on the Chinese market and Chinese games. I have a Uni degree in Chinese studies and translation studies, so apart from games, I also spend a large chunk of my work time translating & proofreading content into Chinese.

After leveling up to level 2 Game Analyst (lol), my everyday work has transformed from just playing and analyzing games into also including more and more interactions with clients, such as consultation calls (aka. “Analyst Chats”) and client onboardings. I also write stuff for the blog, keep an eye out for market trends both on the game genre and feature levels, help out in training our junior analysts, etc. And lately, I’ve been expanding my game resume a bit outside of China as well, including some Japanese and US games. My favorite new task is definitely the Analyst Calls, since it’s a great chance to help our clients develop their games in a very direct and hands-on manner, and the feedback from the clients has been great!

How did you first get into games?

I’ll have to go way back to when I was three years old in the early 1990s when my parents got me and my sister a Sega Mega Drive (or “Sega Genesis” for those of you in the US). My favorite game was Spider-Man – or it might just be that it’s the only one I remember…

At some point, after that, we got a Personal Computer, and oh boy, it was like heroin. My dad gave me a daily time limit on the PC, and if I wanted more time, I had to do push-ups – one push-up for one minute on the computer. Pretty strict, but I’m thankful now. I’ve been a PC gamer ever since, playing mostly strategy, FPS, and flight sims, with a few RPGs in the mix as well (Skyrim, anyone?). On the side, I did some console gaming as well – Nintendo 64 and PlayStation 2 being the most influential ones in my formative years.

Probably like many people, initially, I wasn’t too into mobile games – I would occasionally play Candy Crush, Angry Birds, and the like until Pokémon Go came out. That game completely swept away my prejudice towards mobile as a gaming platform and what could be done with it. And later, since I’ve started working as a Game Analyst, I’ve seen that genuinely good mobile games aren’t even that rare.

Which design feature has impressed you the most in the last few years?

Instead of a single feature, I would name the trend of “social” gaming as the most impressive in recent years. Looking way back, games have evolved from being solitary experiences somewhat similar in a sense to reading a book into shared experiences where players interact and express themselves in the virtual world almost as naturally as in the real world – from classic multiplayer game modes into MMOs, then to Sandbox, and now to a whole plethora of different ways players can spend time together, be it in VR or the mobile platform. In mobile games, this trend has most recently brought about the “social “hangout” space” feature, which has taken different forms ranging from virtual concerts to funny minigames completely unrelated to the core gameplay experience, where the emphasis is on player interaction. It remains to be seen what the next level of evolution for this trend is, in which user-generated gameplay experiences and free social interaction play a key role. However, as a somewhat “old-school” gamer, I hope that local multiplayer makes a revival as well after we’re done with COVID.

People are often intrigued by the unique nature of the Chinese mobile gaming market. Can you name something particular that would be useful or interesting to know about the market?

The Chinese mobile gaming market has traditionally been very “hard-core” compared to, for example, the US market, with the Chinese iOS top-grossing list being almost completely saturated with Strategy and RPG titles. This was probably caused by the fact that mobile devices have been for long the main personal gaming device for most Chinese gamers, and gaming, in general, has not been a very common pastime except for young males. Another factor playing into this is that some subgenres have been easier to monetize than others. The combination of these two factors means that still today, roughly half of the Chinese iOS Top 500 revenue belongs to just three subgenres: MMORPG, Multiplayer Battle Arena, and 4X Strategy (known as “SLG” games in China).

This is not the whole picture, however. Gaming is not only a purely male activity anymore in China, which can be seen, for example, from the appearance of female-oriented MMOs, which lay emphasis on character customization, clothing collection, and romance. The Chinese game market is slowly transforming, as the market keeps growing at a staggering speed, and more Chinese consumers are being introduced to games. This can already be seen in how games from different subgenres and different themes make visits to the top-grossing charts.

However, one thing that still remains true is the fact that RPG elements and a thought-out meta-layer are still indispensable in the Chinese mobile games market. RPG-style meta-layers can be found in almost any game in the Chinese top grossing charts. And often, storytelling elements are a must as well, included even in games that would be amusing enough just with the core gameplay alone. In many cases, the core gameplay (such as fighting in an MMORPG) seems almost irrelevant, as it can be automated, sped-up, or even skipped altogether, while the real emphasis is on the characters and their development in the meta layer.

A completely different story is the Chinese free/downloads list, which is way more diverse than the top-grossing list. It includes lots of casual titles and variation in general, resembling the free lists of other markets more. We have already seen several game types that have first trended on the downloads list and then made their entry to the top-grossing list, for example, Merge Tower Defense and Sovereign games with different themes than being a king or an emperor, such as being a Daoist immortal or the vice-principal of a school. It remains to be seen what other surprises will pop up from the downloads list!