Games using licensed IPs are a steady presence in the top-grossing ranks of iOS games across different markets. Finding the right IP for your genre and market can make a significant difference for your game’s player acquisition, especially in the post-IDFA era. In this blog post, we will be looking into some trends of IP utilization across different major iOS markets tracked by GameRefinery, the US, Japan, and China.

Editor’s Note: This is an extended version of an article on the same topic that we published on VentureBeat.

A good IP will support your chosen game subgenre, player demographic, and game feature set, and these should be knit together from an early stage to ensure an optimal playing experience. As we will see, different markets have different preferences for the types of IPs that are likely to be successful. These have to do both with the kinds of brands players already know and love in a given country, and the game subgenres and features popular in that market, and how these fit with different brands. For example, in more RPG-oriented markets like Japan and China, relatively complex IPs that create opportunities for more immersive character development mechanics are more likely to succeed. Another lesson we will learn is that while choosing an IP brand, it is important to know your target market: the three markets are surprisingly different in what brands are popular in games, with each favoring more local IPs.

United States

Looking at the most successful games in the US iOS market at the moment, it is clear that, with the notable exception of Pokémon GO, the top 10 grossing list is populated with original mobile game titles not based on well-known external IPs.

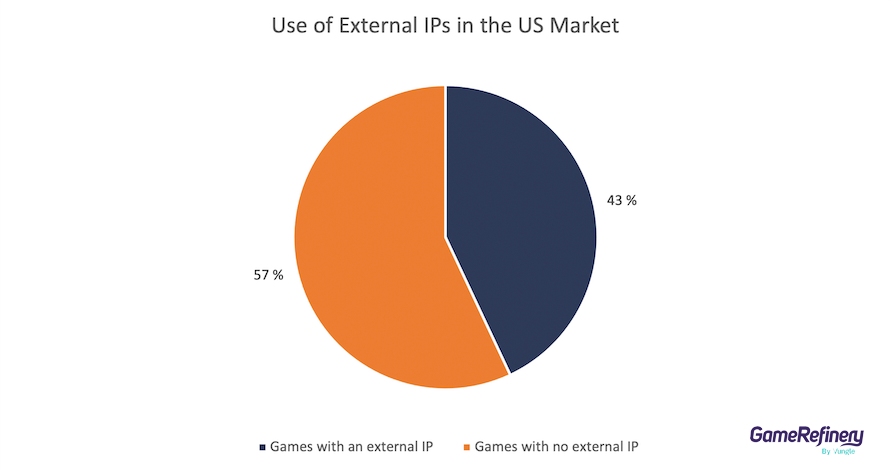

In an earlier blog article from 2019, we found that 24% of top 200 grossing games in the US were using an external IP, excluding PC and Mobile IPs* (these were added to the GR system after 2019). Looking at GameRefinery data, we find that the overall share of IP-based games in the sustained top-grossing 200 is 43%. However, if we exclude games based on existing game titles (PC/Console/Arcade and Mobile), we find that the share is 27%, a modest increase over the situation in 2019.

*PC includes IP such as Call of Duty and Mobile IP such as Angry Birds or Candy Crush

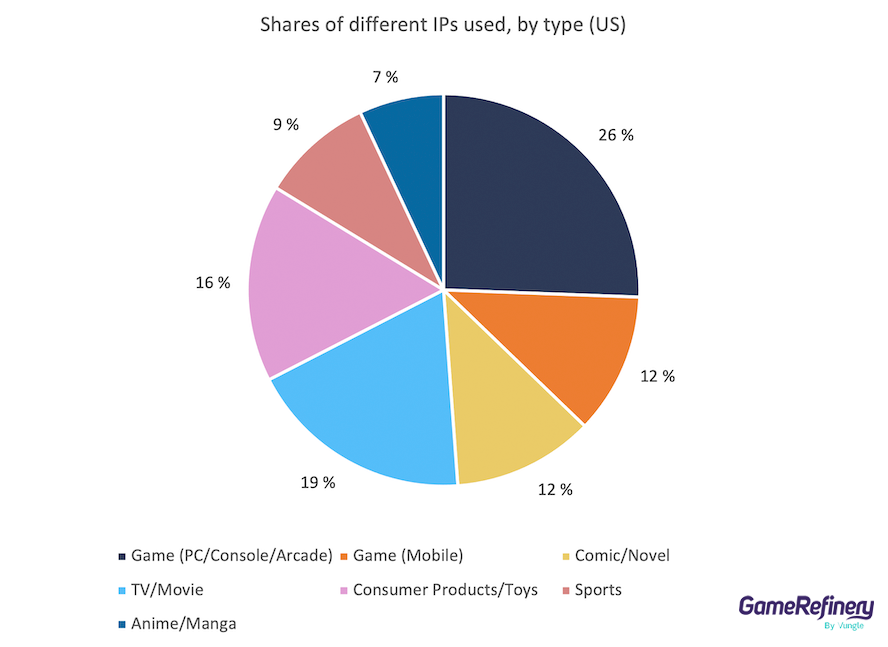

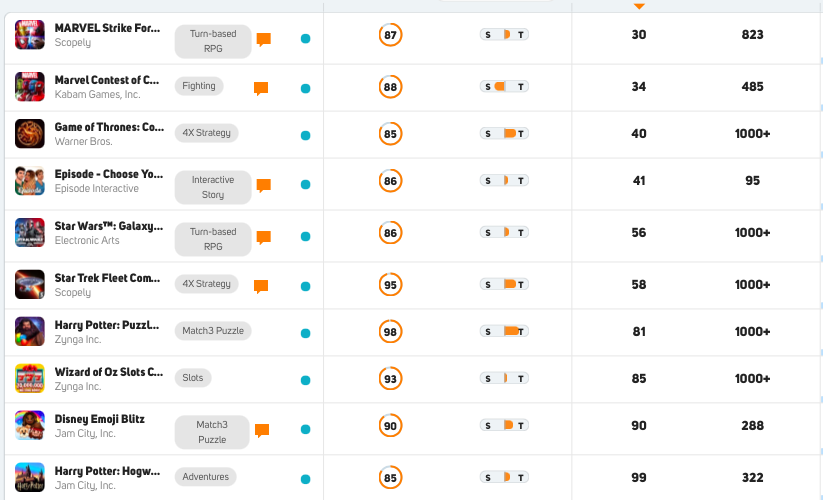

The distribution of different external IP types is relatively even in the US, and it is hard to find one that is a clear favorite over the others. However, TV/Movie and consumer product-based IPs stand out somewhat. Within this IP type, there is a wide variety of games with different subgenres, with Mid-Core games such as Turn-Based and Action RPGs, fighting games, and 4X Strategy games, but also more casual subgenres such as Match 3. There are also narrative-based games such as Interactive Story and Adventure.

In these top 100 grossing games, there are clear synergies at work between IPs and game (sub)genres: IPs with a rich selection of heroes and villains such as the Marvel Universe are combined with RPG subgenres that can fully take advantage of this diversity. The same goes for 4X Strategy games that are able to utilize the existing rich character selection as well as the competing factions dynamic present in IPs like Game of Thrones.

For the US market, the most successful strategy so far seems to have been to take a well-known and loved brand such as the Marvel universe, with a large character roster and a world suitable for an action-packed adventure, and adapt it to an RPG subgenre. The US market also seems to favor the Fighting subgenre more than the other two markets that often opt for Turn-Based or Action RPGs.

Japan

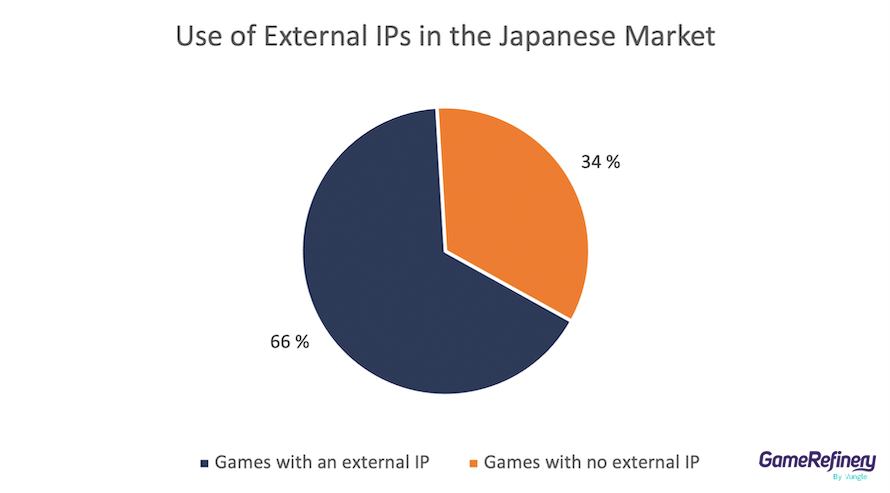

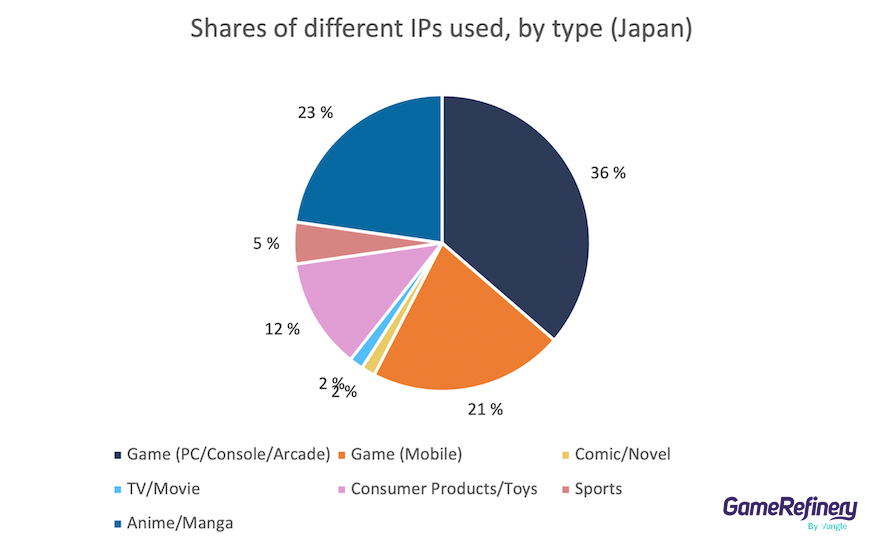

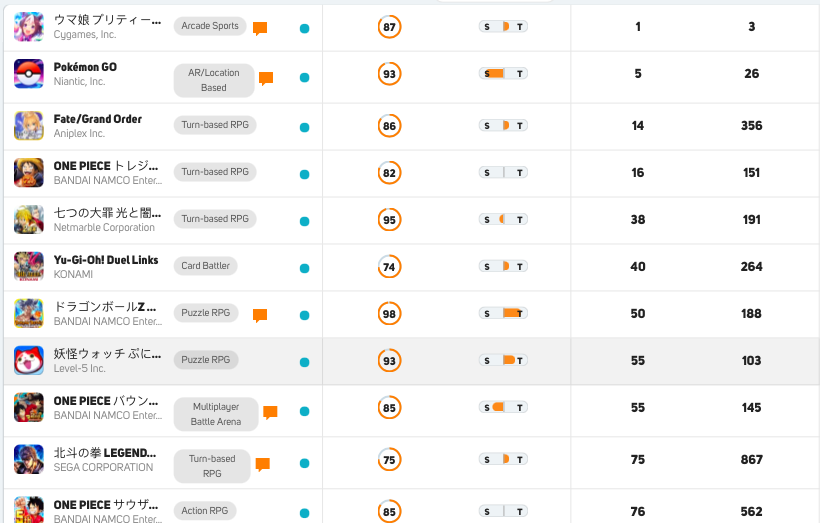

In Japan, what strikes out is that the majority (66%) of the top 200 grossing iOS games are based on some kind of external IP. What sets Japan apart from the US (but, as we shall see, is similar to China), is that a large part of these IPs are existing popular game titles on other platforms, with a full 57% of IP-based games having the Game (PC/Console/Arcade) or the Game (Mobile) IP type.

In Japan, Anime/Manga is the most popular non-game IP used in sustained top 200 grossing games. This mirrors the popularity of comic and TV-based IPs in the US. Since popular Anime and Manga franchises are widely known, they are easy to integrate into the wider brand universe, with engagement-sustaining activities such as social media campaigns and branded goods being common. Another IP type that stands out is the use of PC/Console/Arcade IPs. However, this is often the result of using multi-platform IPs such as Pokémon or others that have both anime and game iterations.

In terms of game subgenres, RPGs and especially Turn-Based RPGs are popular to combine with Anime/Manga IPs. This follows the overall popularity of Turn-Based RPGs in the Japanese market. In the RPG genre, a full 72% of games in the sustained top-grossing 200 list have an external IP. The most popular of these are Anime/Manga with 22% and Game (PC/Console/Arcade) with 30%. While there can be some overlap between these (Fate/Grand Order is an example of a game with both), the two emerge as clear favorites in top-performing RPGs in Japan.

RPGs are often a good fit with Anime/Manga titles since both tend to be character-driven, with existing fan bases both for the title and individual characters. This gives ample opportunities for character collection and development mechanics as well as gacha or other character acquisition-based monetization, as people are likely to want to collect and develop their favorite characters to perfection.

Then again, other subgenres such as Match3 use IPs much less, and many successful Match 3 games are actually the same ones we see in top-grossing lists in other markets such as the US. However, this dynamic changes when we look at the Puzzle RPG subgenre, where Anime IPs are again popular. This includes successful titles like Dragon Ball Z Dokkan Battle (in the top-grossing 50 at the time of writing). This again shows that anime IPs work well with deeper games with character development and collection mechanics.

China

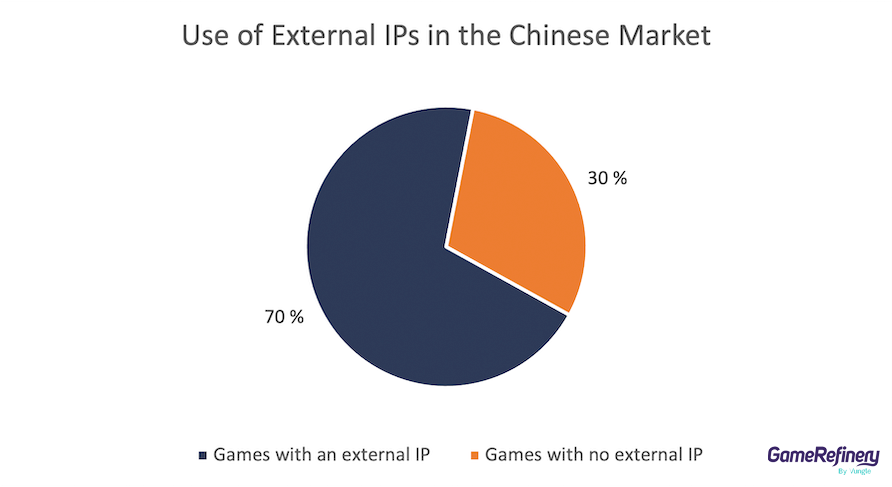

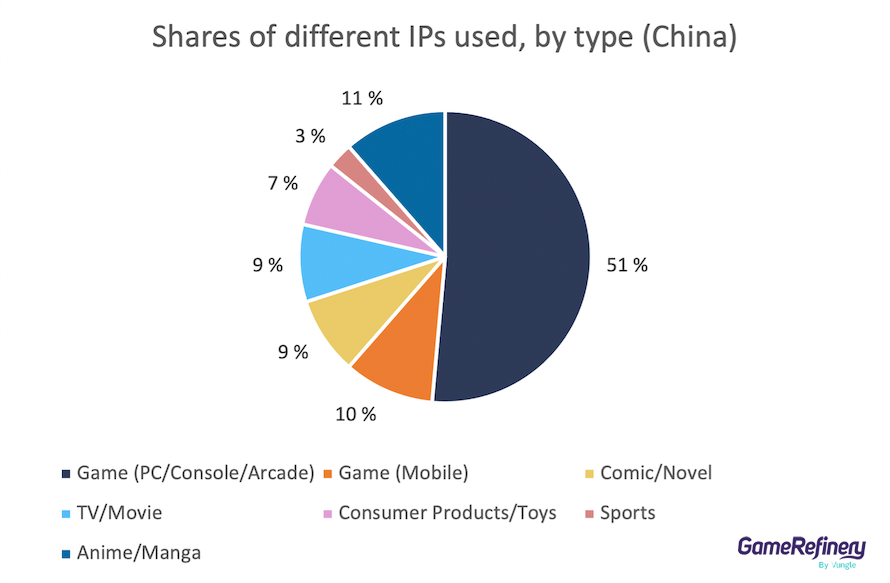

In the Chinese market, games based on PC/Console/Arcade IPs predominate, with a full 51% of games with IPs opting for this type. It should be noted that, since gaming consoles were heavily restricted in China in the past, most of these IPs, in practice, come from PC games.

Among other types of IP, Japanese Anime/Manga titles are also popular, with both localized Japanese games and original productions made for the Chinese market utilizing anime and manga IPs, such as One Piece Fighting Path (航海王热血航线), finding their way into the top-grossing 200. However, all other IP types are relatively evenly represented in this market.

Another highlight is the relative popularity of Comic/Novel IPs, which is explained by the popularity of games based on wuxia (martial arts) and other novels in the MMORPG subgenre. These novels tend to be widely known among Chinese readers and often have expansive character rosters and draw their inspiration from ancient China, which fits the popular aesthetic among many Chinese MMORPGs. Moonlight Blade (天涯明月刀) is an example of a game based on a classic wuxia novel, together with other top 100 titles such as The Demi-Gods and Semi-Devils (天龙八部).

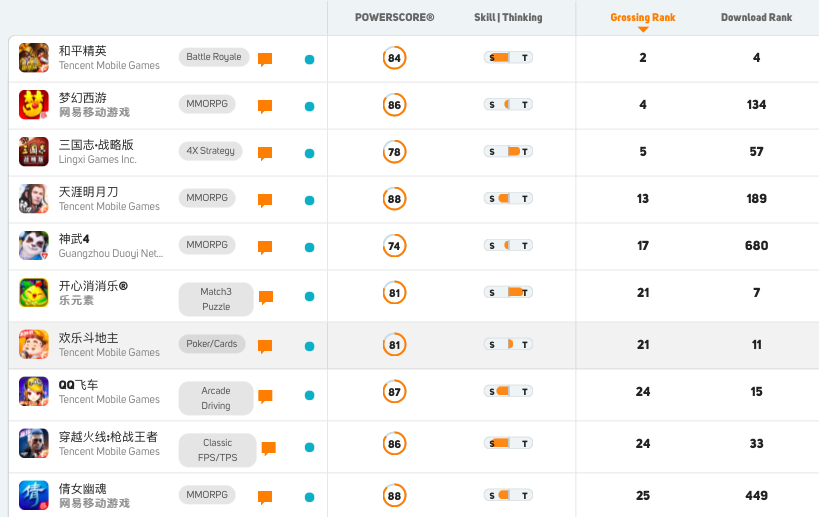

Games popular in the Chinese market lean heavily towards Mid-Core subgenres such as MMORPG and 4X Strategy. A particularity of the Chinese market is that these are often adapted from existing PC game titles, which shows in the form of long, expansive storylines and relatively complex game mechanics. Examples of these games include Three Kingdoms Tactics (三国志·战略版) and Moonlight Blade, both of which are in the top-grossing 20 and are adapted from or based on PC games.

Judging from the IPs popular in Chinese games, it can be said that the game market favors more serious, complex IPs at the cost of lighter IP types that were often originally directed towards a younger audience (brands such as Pokémon come to mind). More expansive worlds and serious, deep in-game storylines and lore are a good fit with Mid-Core games.

What this means: find the right fit for your market and genre

Without the Game (PC/Console/Arcade) and Game (Mobile) IP types, IP use in all markets hovers around the 25-30% mark. This means that there can still be room to discover new opportunities for combining your game with a popular IP. We have seen that the three different markets analyzed here all have significant differences in what IP brands achieve commercial success in the iOS market. In the highest-grossing games, it could be said that local is king: each market favors IPs that consumers already know and love from earlier on, such as anime titles for Japan and Comic and TV for the US. This might seem commonsensical, but it presents special challenges and opportunities for matching your IP with your market and game type, where one IP may work exceptionally well in one market but not be recognized in another.

In the post-IFDA world, IPs can become even more of an asset to making your game find its audience and making it stand out from the crowd. By tapping into an IP with an established base of enthusiastic fans and combining it with the right type of game, you will be looking into a large potential pool of users who will discover your game without seeing targeted ads. IPs can serve as an important organic pathway into user acquisition in the future.

If you enjoyed reading this post, here are a few more you should definitely check out: