With the expansion of GameRefinery’s popular Market Share tool to cover more data points and geographical markets such as China and Japan, conducting category research across markets is easier than ever. This blog post will use the tool to conduct a YoY 2019 & 2020 Q2 mobile game market & revenue share comparison in Japan.

Check out our previous post on the US market here.

What makes this timeframe interesting, obviously, is the COVID VS non-COVID aspect of the comparison.

So what were the biggest market shifts? Which game categories, genres or publishers were able to leverage the market opportunity?

a) All data in this post is based on IAP revenues from iOS top 500 games, “Rev” indicating revenue in Q2 2020, “MS” indicating Revenue Market Share in Q2 2020, “change” indicating the YoY difference between Q2 2020 and Q2 2019.

b) Please keep in mind that Market Share percentages reflect the category / genre / subgenre / publisher’s position in relation to other categories / genres / subgenres / publishers.

c) More information about our genre taxonomy can be found here.

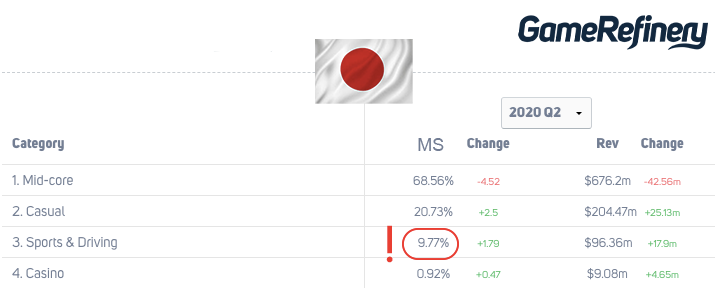

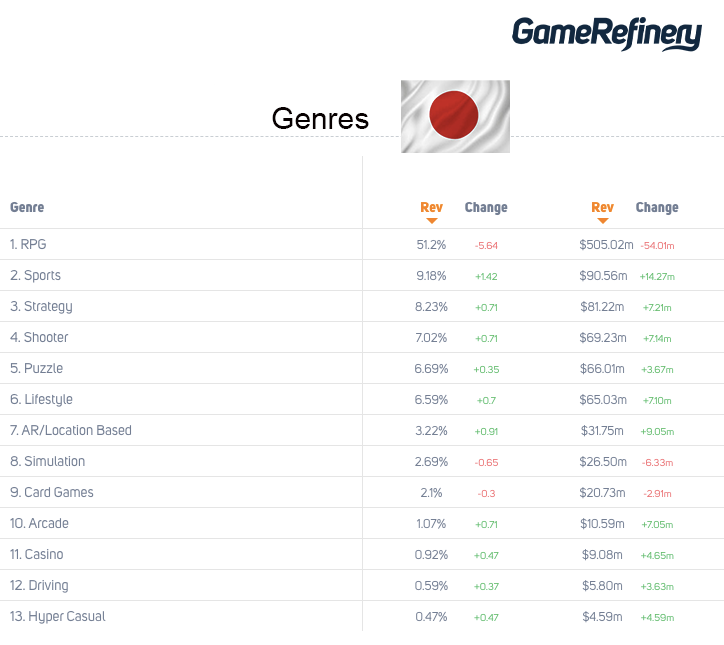

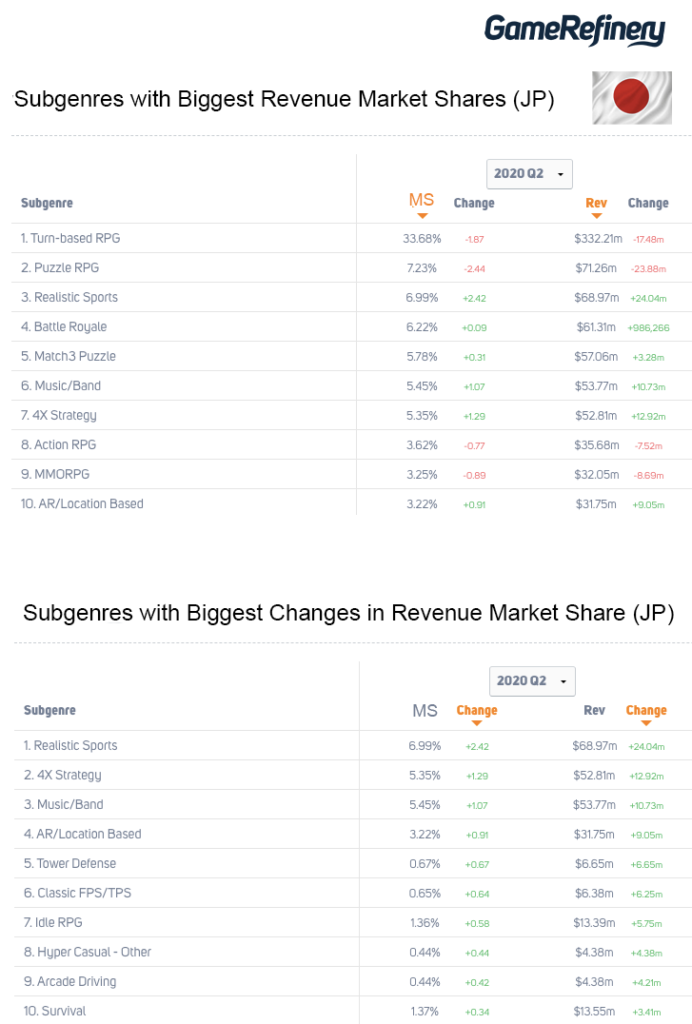

Category, Genre & Subgenre Comparison in Japan Game Market

“RPG is still the dominant genre in Japan, with Puzzle RPGs and TBRPGs alone constituting 40% of the market.”

Key Takeaways:

Category & Genre-level:

- Sports & Driving has twice the market share when compared to markets such as the US or China. This can be traced back to e.g., Professional Baseball Stars’ stellar top 10 grossing performance.

- The Japanese Mid-Core market shrank 4,5% compared to other categories, which was caused by RPGs such as Puzzles & Dragons’ relatively modest June performance and Granblue Fantasy’s steepish dip in May.

- RPG is still the dominant genre in Japan, with Puzzle RPGs and TBRPGs alone constituting 40% of the market.

Subgenre-level:

- Highlights here include the increase in Realistic Sports’ market share (+2,4%) and revenues (+24m). This can be attributed to the good performance of Professional Baseball Stars and eFootball PES 2020.

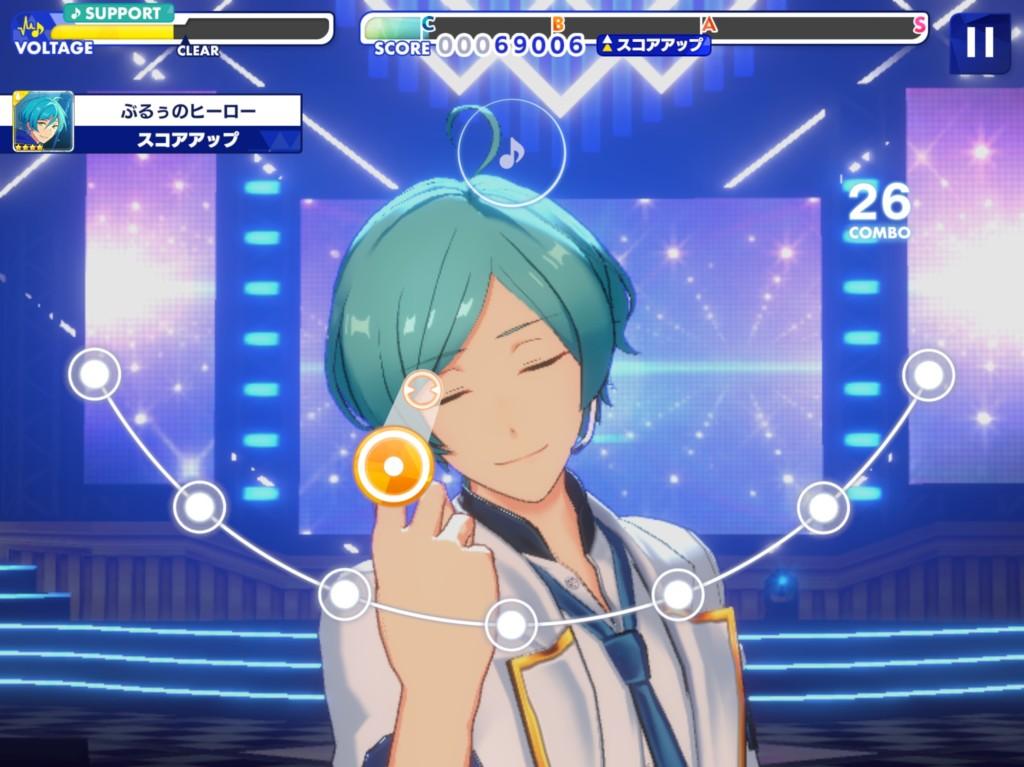

- Other notable market share grabbers were 4X Strategy (mostly thanks to Lilith’s Rise of Kingdoms) and Music/Band (driven by Ensemble Stars!! Music).

- These increases in market share were all carved out of the flesh of Turn-based RPGs and Puzzle RPGs.

Publishers

Key Takeaways:

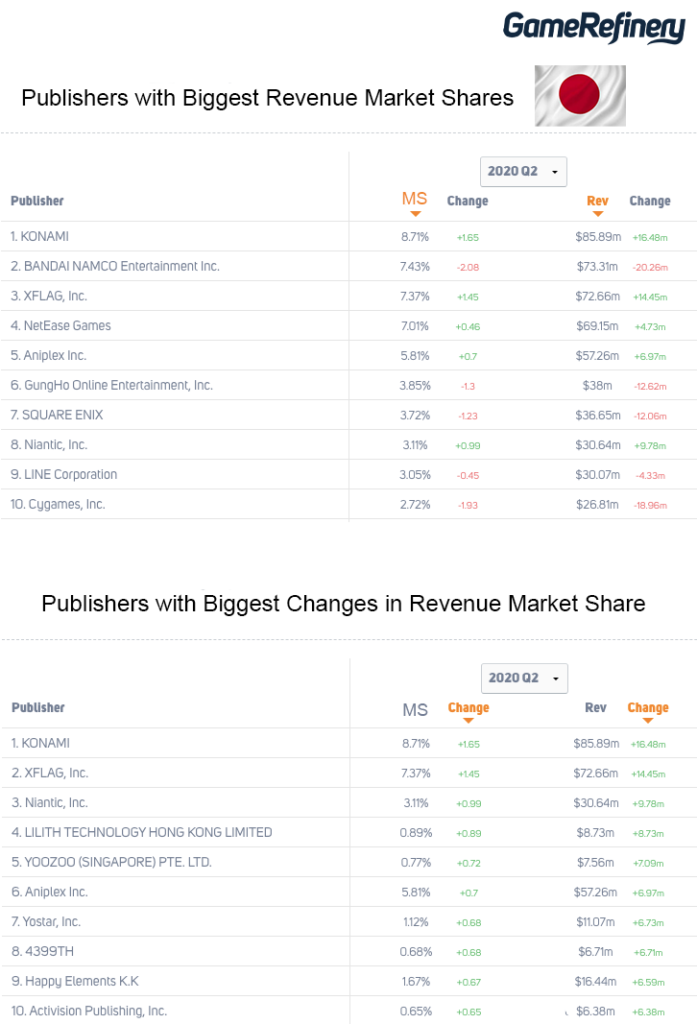

- Konami took over the market leader spot with a 1.65% increase in MS and 16.5m in revenues.

- Conversely, Bandai Namco suffered losses both in market share and revenues.

- Top publishers to increase market share were Konami, XFLAG, Niantic, and Lilith – which went from zero to almost 1%, boosted by the surge of Rise of Kingdoms.

- No western companies among the top 10 MS Publishers; however, Call of Duty catapulted Activision from zero to 0.65% MS and 6.38m of revenues.

Subgenres that Took a Hit in Japan Game Market

Key Takeaways:

- In Japan, RPG subgenres across the board generated less revenue.

- While Realistic Sports was killing it, Arcade Sports was not able to ride on a similar momentum.

In Conclusion

This post explored how mobile game market share has shifted in Japan using GameRefinery’s Market Share tool. TLDR, some of the highlights include:

- Mid-Core, and more specifically RPG, lost MS and generated less revenue.

- Realistic Sports games such as Professional Baseball Stars were one of the winners.

- Konami and XFLAG are the biggest publishers, Lilith put itself on the map with Rise of Kingdoms.

- Activision, with Call of Duty, became one of the top Western publishers in Japan.

Want to see Market Share live in action? Get in touch with us here.

If you enjoyed reading this post, here are a few more you should definitely check out: