Historically, Japan has always been at the forefront of video game innovation, giving birth to cultural phenomena such as Pokemon, Final Fantasy, and even The Legend of Zelda. It’s hardly surprising that the region is continuing its creative streak in mobile, pioneering all-new monetization methods and combining them with engaging gameplay mechanics to build standout new titles — illustrated by the worldwide success of Dragon Ball Legends, One Piece Bounty Rush, Fire Emblem Heroes, Pokémon Sleep, Puzzles & Dragons, and many more.

With over 70 million players generating billions annually, Japan’s mobile market presents a lucrative opportunity for Western game developers eager to claim their own slice of the pie. However, to capitalize on these opportunities, game creators must have a deep understanding of Japan’s culture and the player motivations and preferences of Japanese audiences.

For example, anime and manga are integral to the region’s culture, beloved by both children and adults. Consequently, many Japanese games adopt anime-like characteristics, from character archetypes to similar art styles. Additionally, Japan’s mobile gaming scene features distinct genres that are yet to permeate Western audiences, like idol games, and many titles utilize monetization tactics that differ from the West, such as having a heavier emphasis on gachas.

Below, we examine the Japanese mobile gaming market in more detail, breaking down the biggest genres and discussing the most prominent monetization strategies.

Japan’s biggest mobile gaming genres

RPGs (role-playing games)

Japan’s mobile gaming market spans various genres, but RPGs dominate the landscape.

As of July 2024, 38 of the titles in Japan’s top 100 grossing charts could be classified as RPGs. Comparatively, there were just 11 RPGs in the top 100 grossing charts in the US.

Some of Japan’s most popular mobile RPGs include:

- Monster Strike – Physics-based RPG where players launch their characters around the board, similar to billiard.

- Honkai: Star Rail – a turn-based RPG from the makers of Genshin Impact set in an expansive sci-fi world.

- Puzzles & Dragons – a puzzle RPG with match3 mechanics.

- Goddess of Victory: NIKKE – an action RPG that combines hectic third-person shootouts with collecting and managing a group of NIKKEs (androids).

- Legend of Mushroom – an idle RPG where players follow the monster-slaying adventures of a hardy fungal warrior.

There are various reasons why RPGs are so popular in Japan. The genre was already supercharged among Japanese audiences long before the rise of mobile gaming, as some of the world’s biggest video game IPs, such as Dragon Quest, Final Fantasy, and Monster Hunter, started life as RPGs and were created in Japan.

Similarly, one could argue that the typical structure and stylings of most RPGs share a lot in common with anime: with both seeing players at the start of a journey in a fantasy world, meeting larger-than-life characters, and learning new skills as they go on epic quests to take down a villain and save the world.

Regardless of the reasons why RPGs are so popular in the East, there’s no denying the genre’s profitability. RPGs offer a tremendous opportunity for in-game monetization, from equipment upgrades to new characters, enhanced cosmetic options, and more. RPGs also usually offer players a vast amount of depth, with explorable worlds, lengthy questlines, and complex combat options — all of which bode well for long-term engagement.

Pokémon GO and other location-based games

Most players will be at least somewhat familiar with what to expect from location-based games owing to the explosive impact that Pokémon GO had when it became a phenomenon worldwide after launching in 2016.

Many competitors to Pokémon GO have launched since then, most iterating on the same explore-the-real-world, progress-in-the-game loop. However, in the West, few have had anywhere near the same groundbreaking impact as Pokémon GO, which has now accrued more than $8 billion in lifetime revenue. However, in Japan, several location-based games regularly enter the top 200 grossing—many of which put a distinct spin on the genre.

For example, Dragon Quest Walk adds elements from Square Enix’s popular JRPG series, incorporating turn-based mechanics as players hit checkpoints. Nobunaga’s Ambition: Shutsujin, meanwhile, goes for a more tactical approach that leverages 4X Strategy, while Eki Memo tasks players with visiting rail stations to collect “girls” based on trains. There’s also Monster Hunter Now, which takes a more action-packed approach to Pokemon GO’s ideals, and Pikmin Bloom, a relaxing affair more suited for casual audiences.

The popularity of location-based games in Japan comes down to lifestyles. Most people in the region commute using Japan’s highly efficient public transport, and location-based games are an excellent way to pass the time on the journey. Comparatively, in the US, many people have the luxury of their own car, meaning they will have fewer natural opportunities to take out their phones and play.

Realistic and arcade-based sports games

Another genre popular among Japanese audiences is sports, with heavy hitters such as Konami’s eFootball 2024 and Pro Baseball Spirits leading the pack. There are also multiple popular sport-based mobile games in Japan that take a less realistic approach to sports, many of which are directly based on fantastical and flashy anime series, like Captain Tsubasa, Prince of Tennis, and Haikyuu!.

However, the biggest sports game in Japan by far is Umamusume: Pretty Derby, a multimedia franchise that includes the mobile game, anime and manga products. In the game, players recruit horse girls, oversee their training regime, compete in races, and watch the story unfold. Between 2021 and 2022, Umamusume dominated as the top-grossing game in Japan and continues to maintain a strong, sustained ranking around 15th place to this day.

Idol & rhythm games

In addition to being part of the sports genre, Umamusume: Pretty Derby also belongs to the popular Japanese subgenre of idol games. These “idol” games are focused on rearing some type of celebrities, both real and fictional, with huge fan followings, and can be divided into two categories. The first, which Umamusume falls under, is idol management. While the horse girls in Umamusume are more athletes than your run-of-the-mill idols, they do also perform in flashy stage concerts. Additionally, just like in many other idol training games, players oversee their characters’ development through in-game training programs while uncovering interactive story elements as they progress.

The other major idol gaming type involves aspects of the rhythm gaming genre, so players can enjoy being fans of their favorite celebrities while engaging with music-based gameplay. Often, these games are based on real-life idols (such as in the case of Sakurazaka46・Hinatazaka46 UNI’S ON AIR or Nogizaka46 Rhythm Festival), and can also feature those artists’ real music. Others, like Ensemble Stars!! Music and Project Sekai Colorful Stage feat. Hatsune Miku, feature entirely fictional idols with original music produced for that specific series.

Umamusume also features after-race concerts, so it arguably is something of a crossover between the two types of idol games, which may help to explain its long-lasting popularity.

Rhythm games are generally much more popular in the Japanese market than they are in the West, which likely stems from the region’s affinity with video game arcades where titles like Dance Dance Revolution have been able to really make a long-lasting mark. The five biggest revenue generators in the music/band genre are Japanese, with SEGA’s Project SEKAI COLORFUL STAGE! feat. Hatsune Miku’ being the biggest earner (and SEGA’s most successful mobile game).

Bringing together the popularity of idols and gaming can be a powerful combination, as denoted by the recent success of titles like Gakuen Idolmaster. This title is set in a school environment but focuses on idol management and features glamorous concerts. It danced its way into the top-grossing 10 in Japan and peaked at the top spot for multiple days.

How are games monetized in Japan?

Another key factor behind the success of Japan’s mobile gaming market is it has one of the highest ARPUs (average revenue per user), with players typically spending significantly more on games than they do elsewhere. This high level of monetization means that even niche genres can be profitable because developers don’t need a massive player base to succeed. Instead, they can thrive on a small, yet highly dedicated, audience willing to heavily invest in the games they enjoy.

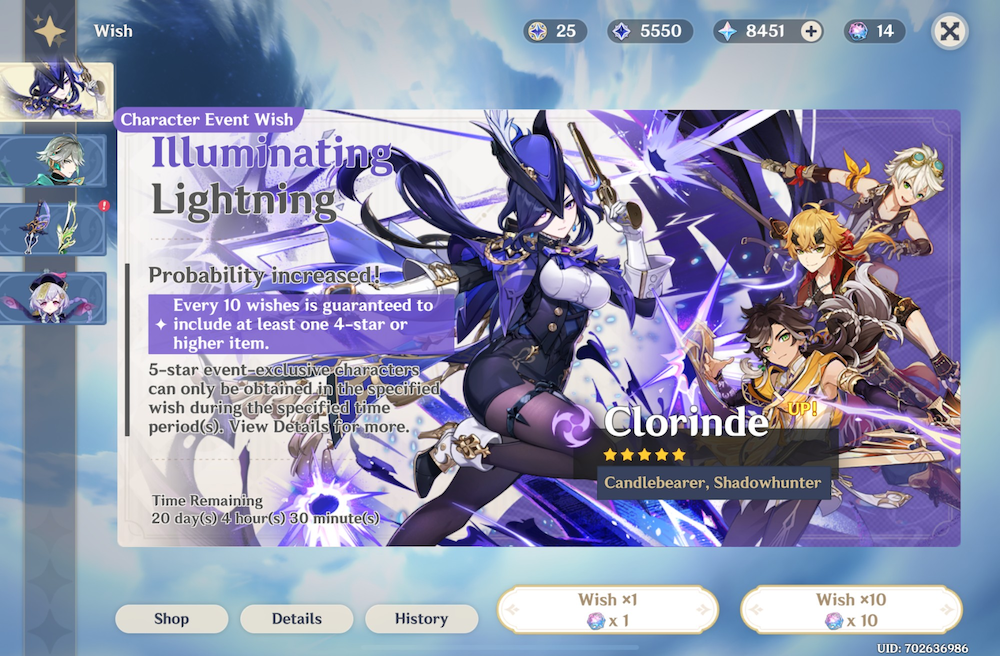

The most prominent monetization mechanic in Japan is gachas. According to GameRefinery data, just over 90% of the top 20% of Japanese mobile games feature a shop with gacha mechanics or refreshing wares – around 20% more than in the US. Gacha is essentially another name for a loot box system: players “pull” the gacha, often in exchange for premium currency or some sort of earnable token, for a chance to win various items from a pool of rewards.

While gachas are featured in many mobile games worldwide, the mechanic first originated in Japan (the first gacha title is believed to be card-battler Dragon Collection). It is speculated to have been inspired by gashapon, toy vending machines stocked full of capsule balls containing random prizes. Gashapon is immensely popular in Japan, with the capsule toy market generating around 72 billion yen in the 2023 fiscal year, so it’s unsurprising that gacha in video games has proven to be such a success too.

Gacha-based game design

One thing to remember about gacha is that the success of this monetization mechanic is largely down to identifying rewards that will entice players. Japan’s highly effective solution to this challenge has been integrating gacha mechanics into fundamental gameplay.

For example, if you look at some of Japan’s most popular mobile RPGs, you’ll notice that most of them depend on collecting characters through gachas:

- In Honkai: Star Rail, the characters you collect in gachas are used to form your teams in turn-based battles.

- Similarly, Puzzles & Dragons has over 1000 characters for players to collect, each of which can be evolved in different ways, opening up almost endless options for strategic play.

- Some games, such as Goddess of Victory: NIKKE, have built systems that allow players to form relationships with gacha-acquired characters.

As these rewards have a fundamental impact on gameplay, the gacha appears more worthwhile to invest in than if it dropped skins, costumes, or other purely cosmetic items.

Japanese games put considerable time and effort into glamorizing their gacha mechanics with flashy animations. If you look at Fullmetal Alchemist Mobile as an example, this game’s primary gacha is presented as an old-school rotary phone. Players “pull” the gacha by inputting three digits into the phone, which then calls a train. When the train arrives, the character the player has unlocked steps out. Dragon Ball Legends also has an over-the-top gacha animation sequence where Goku battles against an enemy and “Kamehamehas” the villain into orbit.

None of this has any impact on the drop rates, but the added interactivity and showmanship make opening the gacha feel like more of an event than in most Western titles, which usually just involve opening chests or pressing buttons.

How to bring a Western game to Japanese audiences

We’ve mentioned many popular Japanese mobile games throughout this blog post. Still, we suspect that even for the less clued-up readers, titles like Dragon Ball Legends and Puzzles & Dragons will be familiar to you as they’ve found success worldwide.

However, while there are plenty of examples of Japanese games making waves in the West, there are fewer instances of Western games breaking into the East. Can developers do anything to ensure their mobile game will succeed in Eastern markets?

Localization is essential

Proper localization is crucial to the success of any game being adapted for the Japanese market. Simply running text through Google Translate or ChatGPT won’t suffice. Developers must hire professional translators to ensure the language is accurate and culturally appropriate. Poor localization, such as broken words or awkward phrasing, can make a game look cheap, unpolished, and ultimately cause players to turn away.

It’s important to remember that localization is about more than just language. Localization efforts can also impact game design, mechanics and monetization methods to cater to the regional preferences and motivations of players.

Leverage Japanese seasonal events

It’s also a good idea to leverage some of Japan’s major seasonal events that might be lesser-known to Western users, such as Golden Week (29 April to 5 May) and Shōgatsu, the Japanese New Year (1 to 3 January). During these periods, most people in Japan are on holiday, so they have a lot of time to play, which is a perfect opportunity to drive engagement.

Some games, such as Legend of Mushroom, launch their Seasonal Events themed around these holidays exclusively in Japan to avoid confusing certain parts of their audience, while others, such as Supercell’s Brawl Stars Golden Week Event, simply release them worldwide. While nuances of the event might be lost on Western audiences here, they can still find enjoyment in unlocking limited-time skins and enjoying other content.

If you enjoyed this blog post and would like to learn more about the Japanese mobile gaming market, tune into Episode 55 of the Mobile Games Playbook.