GameAnalytics’ most recent report is out, now with 1.2 billion monthly players and nearly 100K mobile games studied. Read on to find out what the top 5 takeaways were for H1 2019…

Editor’s note: This post was originally published by Chay Hunter, Director of Marketing at GameAnalytics. With several years of digital marketing experience under his belt, Chay has a strong sense of what growth strategies work well in the mobile gaming industry. So, without further ado, we’ll let him take the lead.

If you haven’t seen the news, then let me be the first to tell you that we’ve recently released our latest — and biggest to date — mobile benchmarks report. Now covering 1.2 billion monthly active players across nearly 100k games, we’ve highlighted the key trends and insights from H1 2019, so that you can see how your title truly compares to the rest of the industry.

Short on time? Not a problem. In this post, we’ve summarised the key takeaways from this study, and what this means for mobile game developers around the globe.

Don’t forget to download yourself a free copy here for later 👇

How to read GameAnalytics’ graphs

We’re packing a whole lot of data into one report, with analysis that covers both seasonal trends and breakdowns by genre. So, to keep things simple, we presented our findings with 2 different plot types: time-series (for trends), and stacked bar charts (for genre benchmarks). This time, we’ve also changed our quantiles, now showing the top 25%, the median, and the bottom 25% of game performance.

And there’s even more…

We now have eCPM and CPI insights inside this report, thanks to our good friends over at Tenjin. This is presented again as a yearly timeline, but also by country breakdown, for both the median and the bottom performing games.

So, now that you’re familiar with our graphs, let’s dig into the top takeaways from the report…

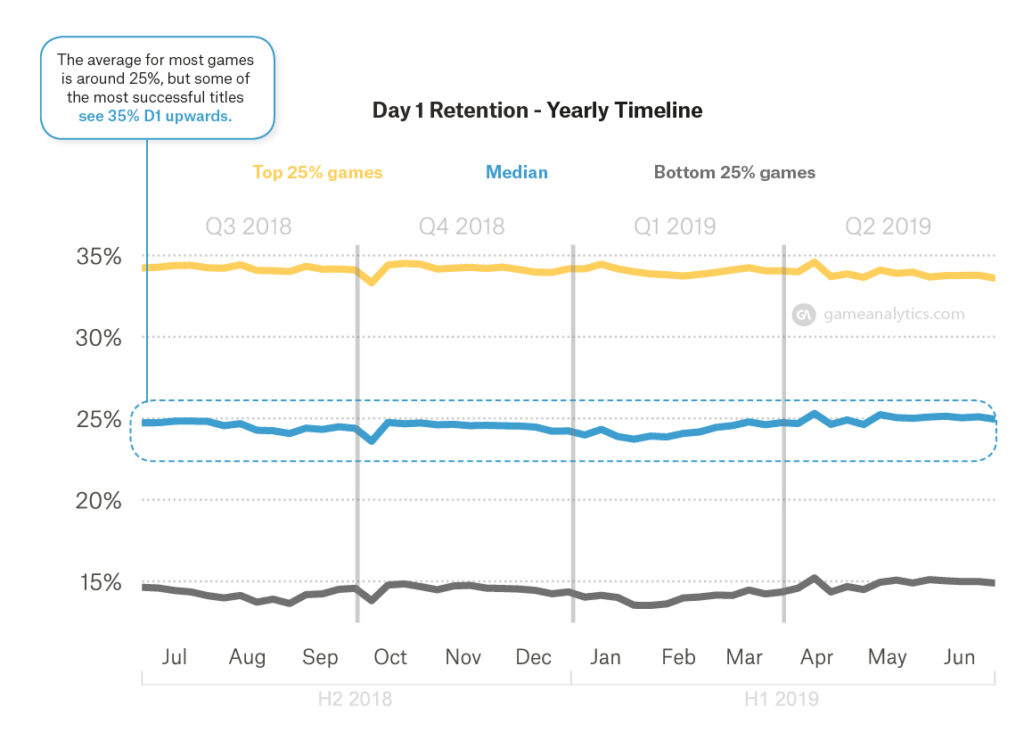

1. If you have Day 1 retention of 35% and Day 7 retention of 11%, you’re doing great

If you’re building a classic, casual, or hyper-casual game, you should be aiming for KPIs around these marks, if not a little higher. Keep in mind, although the median is around 25% day 1 retention, it’s pretty well-known that publishers for the casual category will only review and take on games that are seeing at least D1 Retention of 35% upwards.

Pro tip: it’s all in the testing…

There are a couple of ways you can bump up your RD1 and RD7. The first of which is test, test, test, especially when you’re at the prototype stage or your game. Another thing to consider is doing a well-coordinated soft launch campaign, to understand what it is exactly your players like and don’t like about your game, before you move to publishing.

Here are some usual articles if you want to learn more:

- Prototype Phases For A Hit Casual Game – Purple Diver by Voodoo

- A Guide To Soft-Launching Your Mobile Game

- How To Conduct User Research In The Prototype Stage For Your Game

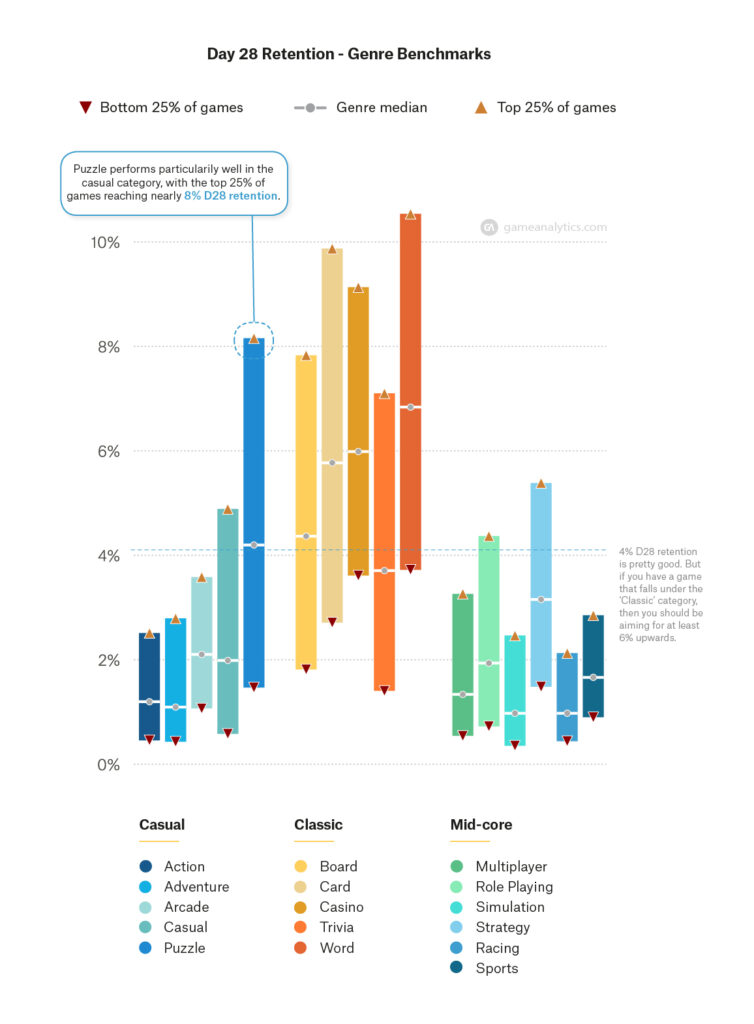

2. The best performing games have around 4% day 28 retention

For the top 25% of games, anything around 4% D28 retention is considered pretty good. But make sure to compare your game to the genre it belongs to, as well as others in its category. We found that a lot of “classic” games (including Board, Card, Casino and Word), are actually seeing double this retention, with D28 up to 10% for the best performing titles, with a median of around 6-7%.

Pro tip: focus on your endgame

If your D28 retention is low, consider focusing more on your endgame. Although this can be tricky to design, great endgames can let your players enjoy your game for longer, without them getting bored. Think about adding PVP modes, daily challenges, and leaderboards to keep them entertained and coming back.

Here are some usual articles if you want to learn more:

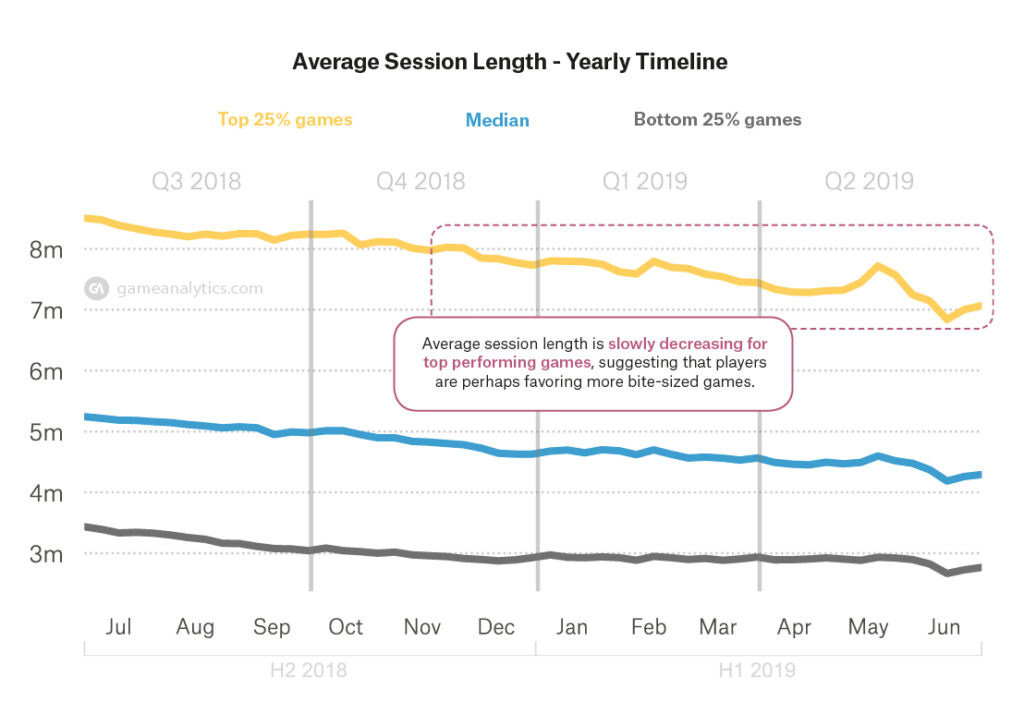

3. A good average session length is around 7-8 mins

When compared to last year, average session length (ASL) for the games industry has actually gone down by 1 minute. This seems to be an ongoing trend, with a lot of genres decreasing by around 30 seconds on average as well, suggesting players are preferring more “bite-sized” games.

However, there are a few exceptions to this change. Casino, Card, Multiplayer and Role Playing games are doing pretty well at encouraging longer gaming sessions, with the top performers showing session lengths between 13-22 minutes.

Pro tip: reward your most loyal players

A good way to keep your average session length up is by rewarding your most loyal players, and making sure you don’t limit their gameplay. If they complete 10 levels and end up playing for 15 minutes, then these players should get something in return for investing so much time into your title. Items, coins, and discounts are all good options, which will not only keep encouraging them to play longer, but also get them to come back.

4. Mid-core games take the lion’s share for IAP

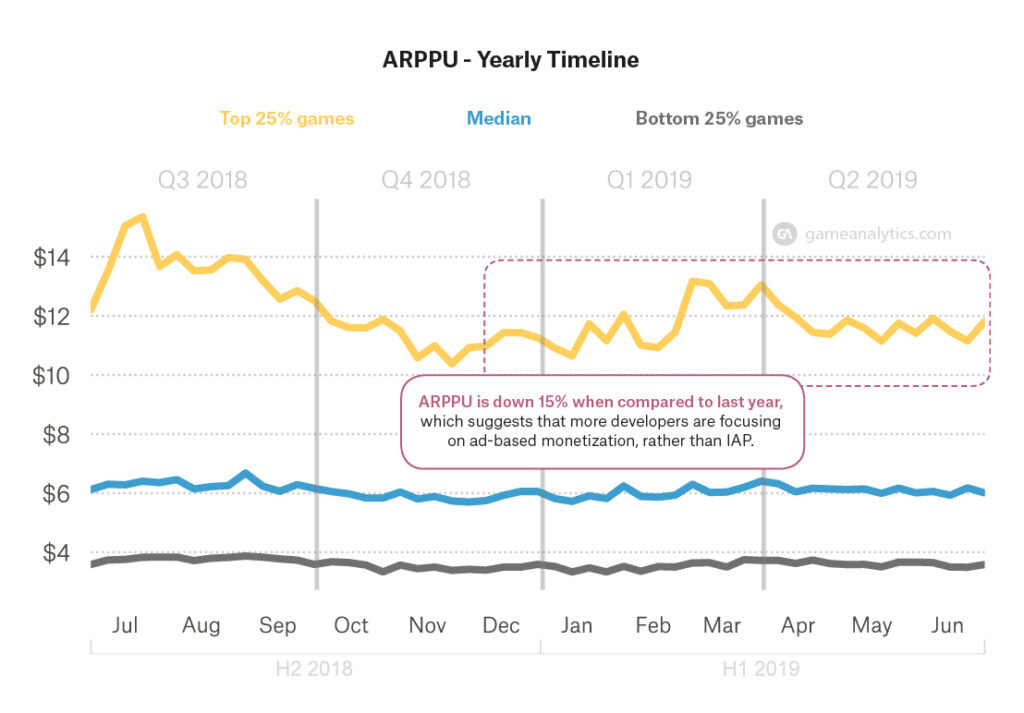

Despite ARPPU and ARPDAU revenue from IAP declining by around 15-20% compared to last year, mid-core games are still showing a lot of earning potential. The median ARPPU for mid-core games is around 3-5x higher than the casual category, and the top-performing Role Playing and Strategy games convert many more players than all other genres, with ARPDAU and Conversion rates performing 5-7x better.

For revenue-based metrics, we also found:

- The top 25% of games for most genres have an ARPPU of $12 upwards+.

- Trivia and Word are the lowest-performing genres for both ARPDAU and ARPPU.

- Average games convert around 0.3% of their players (compared to 0.4% in 2018), but top performing 25% of titles convert 2-3x more than the median.

Pro tip: how to increase player spend

There are a ton of ways to encourage your players to spend more, but it really depends on the type of game you have. A few quick wins include push notifications, timely promotions and dynamic pricing that’ll cater for different player demographics.

But before you optimize your IAP, try focusing on the overall gameplay. After all, people can’t spend money if they aren’t playing your game.

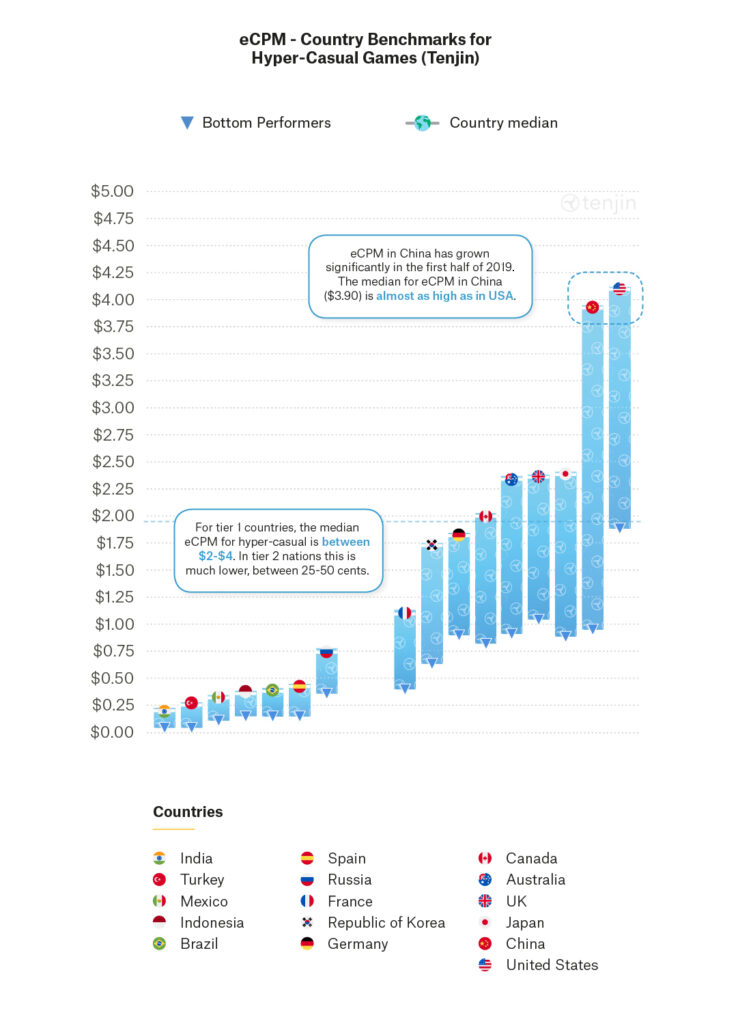

5. eCPM is growing in China (insights from Tenjin)

eCPM (effective cost per mille) for hyper-casual games in China has boomed in the first half of this year, with the median eCPM now almost as high as it is in the USA. Until more recently, China has widely been perceived as a very mid-core focused market. But with more and more casual games being adopted, we’re definitely seeing a big shift in this market reflected in the rising ad costs.

With CPI (cost per install), we’re seeing:

- According to Tenjin, a CPI under $0.30 is pretty good for a hyper-casual title.

- In the lead up to Christmas, CPIs tend to increase about 20% as more advertisers compete to get their holiday UA campaigns on the radars of avid gamers.

- CPIs tend to decrease around the New Year. This is likely trends “normalizing” after increased ad investment in the lead up to the holidays.

Pro tip: don’t be afraid of your competitors

Trying out different ad formats and experimenting with placements are always a good shout when improving your eCPM. It may sound odd, but delivering ads from your competitors can be beneficial for you. That said, make sure you only serve these types of ads to your most loyal players, so to avoid cannibalizing your LTV.

Download your free copy of this report

These were just a handful of the insights mentioned in our latest report, so feel free to download a copy for yourself here. Any questions, ping us at GameAnalytics an email at insights@gameanalytics.com and we’ll get right back to you.